The original was published three-and-a-half years ago,i during which time many revolutions within teh blockchainblockchainblockchain space have conspired to erode Bitcoin’s “market cap” compared to “other” “cryptocurrencies” and the time seems ripe to revisit the subject once again. Vee-one-point-oh has been heavily revised herebelow.

There are still no shortage of pie-in-the-blockchain promises being spewed forth from the self-appointed lamestream leaders in today’s Bitcoin space. “Presenting a revolutionary new way to leverage smart dapps to decentralize electricity distribution and medical records”, or some variation thereof. Sound familiar ?

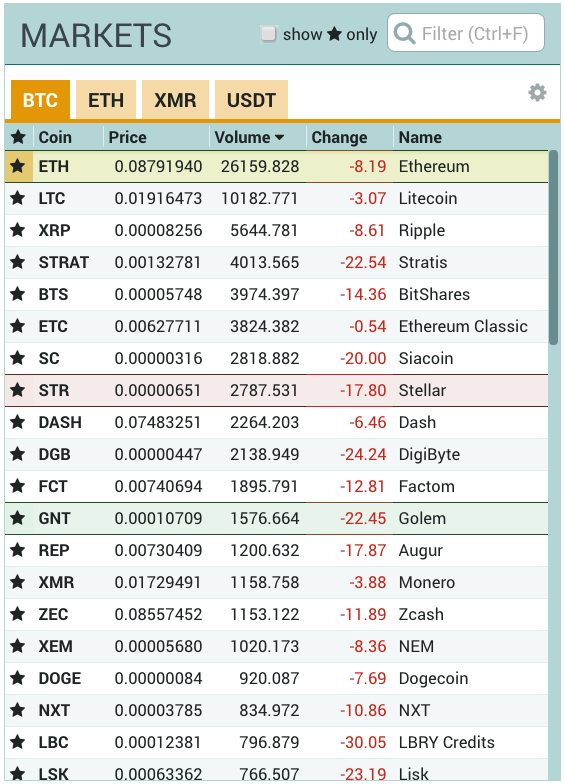

By now you surely have! A few years ago, you might’ve never heard of BitShares, Ethereum, Mastercoin, Dash, Stellar, Monero, Dogecoin, Zcash, the rest of the scamtrash,ii or even the muchly ballyhooed and deceptively vague “ICO”,iii but today, that’s exceedingly unlikely for anyone who’s grown out of diapers. While I admit that this is a very high metaphorical bar, let’s use the most literal sense for now. So you’ve heard of Bitcoin and its “alts,” but can you spot a Wallet Inspector ? Perhaps not, so here are a few ways to identify one :

- Speaks at conpherences, sits on panels

- Shares “hot tips” on Twitter

- Publishes “investor newsletter”

- Discusses “regulatory compliance” seriously

- Promotes “mass adoption” seriouslyiv

- Debates “scaling solutions” seriouslyv

- Opines on “Bitcoin’s shortcomings” seriouslyvi

And so on and so forth. Yet those of us interested in Bitcoin still tend towards idealism and smart-sounding Wallet Inspectors are all too well versed in the buzz-speak and salesmanship needed to capture and retain our attention. While Satoshi quietly proposed a brighter future for humanity by separating money and state, principally by offering transactional privacy of a scarce commodity to interested individuals, now that this is a fait accompli, many of us, most of us even – whether early adopters or ones who’ve very nearly missed the train leaving the station – can’t help but shift our collectivevii sights to the next fantastical image of the future. And presumably, the next one after that as well.

That being said, and despite innumerable painful reminders, we’d do well to recall that pie-in-the-blockchain promises are still just that : promises. GAW Miners promised to “cloud mine” your ASICs, Bitstamp promised to keep your coins safe, BitcoinBourse promised to let you trade securities, and on and on and on. But would you, in your wildest dreams, pay for (much less blindly pre-order) a $15,000 car from a random manufacturer you’ve never heard of, just because they had a glitzy website, some Pixar doodles, and specs promising both 0-60 in 2.8 secondsviii and 200 mpg ? Hell, especially if they made such audacious claims ? As if! You’d only buy such a car, and such promises, from Honda or Nissan because you know that both of these companies have public identities with public executives and a long history of delivering the goods. This is normal logic that normal people have. Yet such logic is completely out the window in the Wild West of “Crypto.” Everyone with two bitcents to rub together thinks they’re an “investor,” but this false sense of security and unwarranted sense of superiority just makes them gibbled prey for the wolves with slick websites and calculated appeals to instant riches. So it’s no surprise that these wolves are consistently able to raise millions, even TENS of millions of dollars worth of “alts” only to disappear quietly into the night with the loot, all of which is as criminal as it is preventable.

It’s hard to say how many times the wolves will be able to shear the sheep but there’s probably no limit. Although time breaks bullshit, there are always more sheep to shear. The fly-by-night operations and their skeezy operators will therefore continue to come and go, but their proportion of the Bitcoin Economy will continue to dwindleix as legitimate players outwit and outlast them, leaving the wolves to shear little more than altcoins, which is exactly what we’re seeing today with Ethereum/USD-denominated ICOs.

The solution : Buy all the bitcoins you can, store them properly, and wait.

These are still the very embryonic stages of something monumental. Rest assured that Mother Nature will weed out the useless mutants eventually, just like she always does. So before you throw more valuable coins on yet another promising-sounding promise (eg. Kik,x Brave,xi Omise,xii etc.), consider more than just what’s being promised, consider who – whether Wences or Vitalik or Bahamas – is making the promise. If they’re an unknown quantity, which they pretty well have to be by definition, you’re “investing” with them in the same way that you “invest” with a wallet inspector.xiii

Trust them at your peril. Because it’s all about trust.

___ ___ ___

- Did the $150k you spent on an undergrad degree do more for your future than a few hundred BTC would’ve ? I don’t like your odds but what’s done is done and here we are, about to crack some eggs with the class of ’21. Will they be any the wiser ? ↩

- PoorLonelyEx (Poloniex) is the current home of these tradable tragicomedies. It used to be BTCT and BitFunder, before which was GLBSE, and when I rewrite this a third time it’ll almost certainly be something else. Change, it’s what the revolution does best!

-

- Another almost-four-year-old article speaks to exactly this “mass adoption” fallacy. Self-recommending. ↩

- While the scaling debate is more recent as 1MB blocks have only become full in the last year or so, it’s equally a red herring. ↩

- For the record, there’s no Bitcoin 2.0 – not in your lifetime – and the only people qualified and authorised to discuss its successor are in #trilema on freenode. There are no exceptions. ↩

- This is what “collective” means, eh ? It means that you go from flower to flower to flower smelling them all but never stopping at The One. No, there’s not only one The One in life, there are a handful presented to each and every one of us, but how many stop for the weeks, months, and years needed when each The One arrives ? And how many more keep going onto the next day in and day out ? The many more, that’s the collective. ↩

- Call it Blackzilla speed for good measure. ↩

- In BTC terms, there are no others. That “other” “cryptocurrencies” have such and such market cap only speaks to the proportion of capital fleeing $USD into anything else not the proportion of BTC held by serious players. ↩

- Kik is yet another messaging app. ↩

- Brave is a “web browser” that “raised” “$35 million” in 24 seconds. ↩

- Omise is a “fintech” startup based in Thailand. ↩

It is lolzworthy to have noticed mETH losing appx. $17.5 billion USD in market cap over the past month. The ICO ecosystem is good for Buterincoin.

Dem crabs in a bucket.

[…] locals. Word of the family’s “alternative” holdings had leaked and collective discontent ensued. Indeed, the family still held a measure of foreign currency and the […]

[…] Pete, shouldn’t be be hodling and beating off every Johnny-Come-Wallet-Inspector with everything at our disposal from shoes to baseball bats to fallen tree branches ?” Well, […]

[…] all use of force and to which you defer to so spinelessly has no leg to stand on online. So the wallet inspector is your daddy, which is great for you because there’s clearly a daddy-shaped hole in your […]

[…] >1 BTC, which is pretty much exactly as it would be in a more ideal world. The idea that “everyone is an investor” is like saying that “everyone is a firefighter” and “their own best […]

[…] Kickstarter campaign of 2017 was very much the “Initial Coin Offering.” Few if any delivered products or made any meaningful progress towards that end despite […]

[…] (and co-conspirator in the Keisercoin ICO scam from the days before such scams were called “ICOs“) were seen flipping through to the acknowledgments in the back of the book to find that […]

[…] Bram Cohen Imagine Bitcoin Mining Companies 33. The Ethereum market cap fallacy. 34. The Wallet Inspector’s Promise v.”ICO” 35. The implications of Bitcoin for inheritance. 36. Worried about the fork? 37. SegWit toljaso […]

[…] Oil & Gas “ICO” pumping machine. […]

[…] periods between manias when the lamestream “wavers” malevolently hype up “ICOs,” “blockchains,” “cardanos” and other tangentially and tenuously […]