One of the very strange and often inapplicable carryovers from the world of equity investing to the world of, well, almost every other investible asset, is the idea of market capitalisation. Cryptocurrency suffers this odd affliction – largely at the hands of CoinMarketCap – so it’s perhaps no surprise that the world of NFTs is now trailing closely behind.

In equities, market capitilisation, or “market cap,” refers to the overall value of a company as determined by share price multiplied by outstanding share count. Now, the use of a market cap has all kinds of crazy assumptions baked into it, not least of which is the relatively implausible Efficient Market Hypothesis and the notion that you could “buy the whole company” for a proportional if not precisely identical price.i This makes “market caps” a frequently seductive metric that allows soi-disant “investors” to compare apples-to-apples to determine whose is bigger which company in a given sector is the most “valuable” and therefore how exposure should be determined, at least for the sort of narrow-minded charlatans constructing portfolios using VaR, Black-Scholes, and similar risk assessment tragedies, but we’ll hold off on more Talebisms for a moment because we have newly emergent digital markets to fry, viz. collectable NFTs in general and serial-number contingent NBA Top Shots in particular.

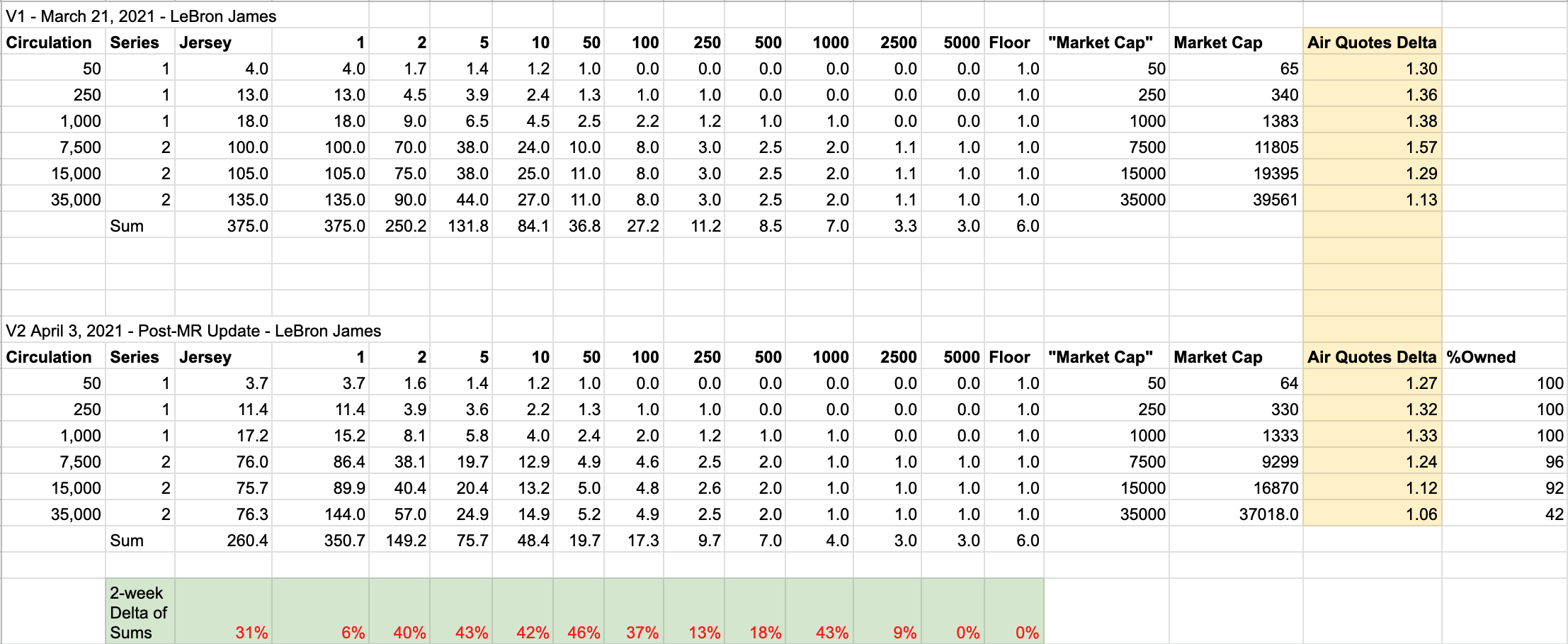

Before digging into some of the numbers, my alternative hypothesis was that the TS market would have some, well, inefficiencies. My hunch was mainly that the “underpricing” of the MGLE set relative to the base set – as philosophised by PlungeFather, Mat Houchens (of AddMoreFunds), Michael Levy (mbl267), Andy Chorlian (andy8052), and chugsnbugs earlier this week – was a greater function of varying convexities being falsely flattened by the assumption of consistent low ask prices across the distribution (as promulgated by evaluate.market and the like). To test this theory, I smoothed out some of the jagged curves from my serial number thesis post and here’s what I found (click to enlarge):ii

What we can see from the pale yellow highlighted column is that the “market cap” as commonly quoted and my crudely smoothed calculation of the area under the curveiii are pretty consistently proportional, with the former undershooting the latter by ~25-35%. Only the 7`500 circulation size moment was disproportionately overvalued in terms of market caps relative to its peers in the V1 calculation, but since MomentRanks just updated their “machine learning” algo a couple days ago, and that’s what all this data was based on, as we can see in the V2 calculation, this outlier overvaluation was gone. Since I was looking for dislocations or inefficiencies closer to 30-40% in the higher circulation moments relative to the lower circulation moments, I’m going to have to say that the alternative hypothesis was rejected! Null hypothesis not refuted! Which is simply to say that my hunch was wrong and that the floor-based “Market Cap” is every bit as consistent as the area-weighted Market Cap I so crudely calculated.iv That being said, while one finding was smoothed away, what popped up in its place was a pretty obvious undervaluation of the 35`000 circulation size moment, which probably isn’t quite as interesting because I think it can be fairly explained by the low % owned at present.v But even if we’d failed to reject the alternative hypothesis and saw discrepancies in this domain, why is “market cap” important again? The jury’s still out on this as far as yours truly is concerned.

Anyways, you’ll note that MR doesn’t publish “market cap” data, which is one of the reasons why they’re my go-to resource, another of which is their machine learning serial estimating algo, which we area seeing is quickly evolving and, well, learning! This brings us to our second observation as seen in the pale green row: serial number compression, or how “average is over” to borrow a Tyler Cowenism.

What’s remarkable about this particular market evolution is that, in just the last two weeks since my initial analysis, there was a very pronounced downturn in non-floor-non#1 serial numbers. While the floor of the market was down over the last 2-3 weeks by 40-50% in dollar terms, the table above is about relative proportions, which therefore doesn’t (or at least shouldn’t but maybe is?) take downward/upward market pressure into account. Regardless, non-floor-non-#1 serial numbers are being smashed lately, and not in a good way, at least for someone who’s been focusing on top 1% serials in their early collecting *cough*cough*. But hey, live by the algo, die by the algo! I’m still bullish AF.

While this trend of hollowing out the middle may or may not continue, there’s reason to believe that it will regardless of in-game (ie. Hard Court) benefits accrued to moments of “higher rarity,” whatever that even means. So if we are indeed on a path of serial number compression, this indicates increasing value in a bifurcated portfolio whereby #1 serials in any Tier and floor-priced moments in the Legendary Tier are prioritised. Call it an asset-specific “Barbell Strategy,” if you will, to borrow yet another Talebism.vi I’d keep this new strategy to myself while I execute it but it’s not like anyone actually reads Contravex so who gives a shit!

Plus, the Barbell Strategy isn’t really a novel idea in this space. There have been similar suggestions on various community podcasts (maybe the Wades @ OTM one? I can’t recall exactly, I can barely keep track of all the content anymore, but that’s a great problem to have because it’s generally pretty high signal-to-noise ratio material!) that over time we would see a compression between the high and low serials, partly because this is how the cardboard world works (ie. traditional trading card world)vii and so the table above is now just some early directional evidence to support this thesis. While I’ve already dipped a toe at least two toes into the Top Shot waters using my V1 Strategy, and part of me wants to just diamond-hand my holdings into the sunset, another part of me wants to honour this new information, pivot accordingly to a V2 Strategy (without liquidating any current holdings), and double-down on the platform.

This might happen, it might not. It might make sense to do so, it really might not. But the mad scientist gambling degenerate in me is still as enthralled as ever with this beautifully puzzling space and I can’t bring myself to look away now. Feel free to join along as this train wreck unfolds. It’s unlikely to disappoint.

___ ___ ___

- You think you’re going to execute a leveraged buy-out of an entire circulation of a TS moment? Or a cryptocoin? By persuading 51% of owners to sell and legally coercing the rest? The fuck’s the matter with you? THIS ISN’T FIAT!! ↩

- An example of one of my formulas is herebelow for your auditing/amusement. Keep in mind that I can barely walk, talk, and chew gum and that Excel formulas are hardly my forte, but hey, you gotta try new things sometimes:

=( (A5 – N1) * N5) + ( (N1 – M1) * ( (N5 + M5) / 2) ) + ( (M1 – L1) * ( (M5 + L5) / 2) ) + ( (L1 – K1) * ( (L5 + K5) / 2) ) + ( (K1 – J1) * ( (K5 + J5) / 2) ) + ( (J1 – I1) * ( (J5 + I5) / 2) ) + ( (I1 – H1) * ( (I5 + H5) / 2) ) + ( (H1 – G1) * ( (H5 + G5) / 2) ) + ( (G1 – F1) * ( (G5 + F5) / 2) ) + ( (F1 – E1) * ( (F5 + E5) / 2) ) + E5 + D5 + C5

Extra spacing required so that WordPress doesn’t add a shit ton of footnotes innit. ↩

- Fuck me if it hasn’t been 15 years since I took calculus but that shit would come in handy right about now. Who said that advanced math didn’t have real-world real-life applications?! ↩

- This analysis still doesn’t quite resolve the debate about MGLE being over/undervalued relative to Base sets, but I still don’t have a good null hypothesis or even a gut feeling with which to test against. Taylor Stein has an interesting theory on this topic but I guess I still don’t fully grok it. If my dear readers have other theories or analyses, feel free to let me know in the comments. ↩

- As you can see in the table above, these equations/estimates were based on LeBron James moments because 1) he’s objectively the most sought-after and 2) he’s anecdotally one of the most liquid (although his holos/cosmics are anything but liquid for as long as the $250k marketplace maximum is in effect – speaking of which, can we bump it to $1mn already?). Anyways, I also tested these results against Steph Curry and found nearly identical proportions. ↩

- This stacks up with my general thesis of highly networked environments that there are Schelling Points around winners and resultingly massive disparities between winners and losers. I was sort of hoping that being in the top 1% of a circulation would be enough to yield outsized returns, but I’m now having to reassess that for an estimate closer to the top 0.01%. The world is so unfair! But the sooner we recognise and accept this fact, the sooner we can position ourselves to profit from this knowledge. ↩

- When discussing my new serial compression observations with The Girl, she looked at me like this was the most obvious thing in the world. Over the last 25 years, her father has built one of the most impressive Wayne Gretzky cardboard/memorabilia collections in the world and she was tasked with cataloguing the whole thing for insurance purposes just last year, which entailed obtaining price estimates for everything. And in the cardboard world it’s definitely the case that you want to be in a small run (ie. Cosmic/Holo equivalents) or #1. Being #12 in a run of 35`000 just doesn’t move the needle. Sad as this was for me to learn now! But hey, education ain’t free so what can you do. ↩

Pete, how do I make money? I know you’ve got some secrets. you can email me at richlautner93@gmail.com

Please help me out brother.

Hey Rich, have you tried The Universal Plan for Wealth?