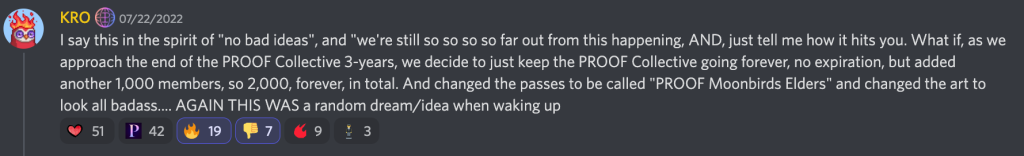

Right up there with “sustainability,” you’ve probably noticed that “transparency” is one of the most horribly abused terms of our moment. But what’s so great about “transparency” anyways?

The recent Proof/Moonbirds debacle is an interesting case study contra “transparency” – as is the more “Lindy” (and M2-manipulating) example of the US Federal Reserve – so let’s take a look at each of these cases individually to see if we can find a common thread. First, Proof/Moonbirds:

In this moment of “transparency” utter suicidal fantasy, the incredible degree of trust that Kevin Rose had built up in his “Next Yuga Labs” vision for Proof/Moonbirds took a sledgehammer to the side of its head and wobbled woozily off into the bushes to shed a couple litres of blood. But that was nothing compared to the “Fanny Pack Attack” that ensued following the underwhelming Silver Nest Rewards – which Zeneca_33 elegantly exploredi better than we could here – but suffice to say that a whole lot of “transparency” led to a whole lot of expectations WAY UP HERE compared to the eventual reality that came in somewhere in the heaving chasm down below. Ouch.

But KRO wasn’t done self-immolating yet. Hot on the heels of this public disappointment and the frog-boiling heat it engendered came a completely-out-of-the-blue IP announcement that was arguably the nail in the Moonbirds coffin, if not the larger Proof umbrella. After praising the BAYC rights model to kingdom come, KRO pulled a one-eighty with Moonbirds by following XCOPY and Toadz into the Wild Wild West of IP Freedoms: CC0. CC0 (pronounced “see-see-zero”) is a free-for-all intellectual property rights framework that, as far as I understand, is both the extreme limit of open use without possibility of prosecution as well as irreversible. The long and the short of it was that KRO didn’t much appreciate sleeping in the bed he’d made for himself and was now saying “fuck it, you want this so bad, it’s yours” to the sheep he’d shorn for $80mn back in April of this year with a minstrel’s tune of “utility” (ie. free shit like parties, swag, and NFT airdrops). Apparently having forgotten to practice what he preached, KRO used to talk about “underpromising and overdelivering” but he now seems to be mostly doing the opposite. Blame transparency!

Because while it’s possible to be open, honest, truthful, and understood by a single-person audience (though even this is no small undertaking), it’s literally impossible to do so for a multi-person audience and even the approximate ability to be understood completely degrades dramatically with scale. Ergo, the larger the audience you’re speaking to, the more obscure and imprecise you must be in order to be persuasive, not to mention survive as a leader in a social landscape where your credibility is necessarily predicated on your track record (and symbols thereof).ii

Speaking of dubious track records, let’s look at the US Federal Reserve, starting with the July 2022 FOMC statement:

Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. […]

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Of course, even the Fed has tried to become “more transparent” since 2007,iii but to what functional end other than to babysit the almost completely subjective échafaudage that is the American “economy“? Or even if that’s necessary and sufficient at this stage of the demographic/debt/fourth-turning game, reading through these monthly published transcripts, they’re pretty fucking open-ended wouldn’t you say? “But Pete,” you reply, “J. Powell is still a criminal liar not to mention a malicious idiot who should’ve started quantitative tightening (QT) slowly way back in mid-2021, not bonzai tightening halfway into 2022.” Well, that may be true, Timmy, but it elides the function of the Great Wizardiv J. Powell’s unofficial mandate, viz. confidence.

And what is “confidence” exactly? Near as I can figure out, “confidence” is very close if not identical to what used to be known as “faith” in the pre-secular world. Extending that thought, we can see a through-line between the US Federal Reserve and none less than philosopher Søren Kierkegaard (1813-1855). Come to think of it, the intentionally impenetrable Dane probably would’ve been a first-rate Fed Chairman had he been born 150 years later (to a Jewish mother), as we can well glean from William McDonald writing for the Stanford Encyclopedia of Philosophy:

In combination with the incessant play of irony and Kierkegaard’s predilection for paradox and semantic opacity, the text becomes a polished surface for the reader in which the prime meaning to be discerned is the reader’s own reflection. Christian faith, for Kierkegaard, is not a matter of learning dogma by rote. It is a matter of the individual repeatedly renewing h/er passionate subjective relationship to an object which can never be known, but only believed in. This belief is offensive to reason, since it only exists in the face of the absurd (the paradox of the eternal, immortal, infinite God being incarnated in time as a finite mortal).

Kierkegaard’s “method of indirect communication” was designed to sever the reliance of the reader on the authority of the author and on the received wisdom of the community. The reader was to be forced to take individual responsibility for knowing who s/he is and for knowing where s/he stands on the existential, ethical and religious issues raised in the texts.

Doesn’t that kind of intentional opacity sound like a formula for effective leadership? It certainly does for every King, Queen, Sheik, or Shaman there ever was, so why not KRO and the rest of the transparency-istas running around spilling their dumb guts? I’m not sure that I have a very good answer for that other than to say that such bad behaviour is inherently self-correcting and self-limiting.v

Which isn’t to say that good leadership is easy, obvious, or inevitable. Au contraire. Good leadership is really, really, really hard. As Paul Graham observes:vi

Effective organizations are unnatural. The natural state of organizations is bureaucracy and turf wars, and once deprived of effective leadership they revert to their natural state with shocking speed.

— Paul Graham (@paulg) August 7, 2022

All of which is to say: You want the truth? YOU CAN’T HANDLE THE TRUTH.

It’s true though. At least if you want to be sustainable…

___ ___ ___

- Archived. ↩

- Oh you think gaudy jewelry, fancy clothes, and fast cars are a “waste of money”? How about seeing them as “proof of work” and therefore worthy of respect, if not demanding of it? Maybe if you stopped being so green with envy for a second, you’d see what I see. ↩

- Archived. ↩

- Make no mistake about it. In the US’ hyper-financialised banana republic economy, the US Fed Chairman is the right-hand-wizard to the President, just as the shaman was the right-hand-wizard to the tribal chief. There is ZERO difference between the two. ZERO. ↩

- Just like anxiety about having kids!

- Archived. ↩

[…] whether that’s Jerusalem or Vatican or Giza or Mecca or Davos – which is why BAYC/MB primary value prop was “parties” (that fry your eyeballs… in more ways than one). […]