Psyched for Moonbirds? Me too! So let’s quote liberally from the recent chat with my finest protege vis-a-vis the three-per-wallet-dutch-auction-no-wait-we-mean-two-per-wallet-dutch-auction-no-wait-we-mean-verified-raffle schmozzle that’s been the most hyped PFP project since, what, Meebits? Except like 10x that.i Right:

Pete D: Thoughts on the Moonbirds raffle?ii

NFTier: Gm Pete! Well, I think people are being too harsh on them for choosing a raffle over a DA. I think Kevin laid out fair reasonings as he acknowledged that the DA would sell out at 2.5Eth (there would be no price discovery anyways), and also that in reality it would require more like 3.5Ethiii in a wallet for a gas war as opposed to 2.5Eth. I think Pre-mint with additional measures is the best possible way to go for a raffle (Murakamiiv had a raffle a few days ago which got 5M plus entries but it was very poorly designed). I think my concern from the beginning, which I expressed to them, was that due to the pricing, many smaller wallets will be priced out. Their goal with Moonbirds was to be inclusive but that is hard to do at that price point. The raffle will at least give those who saved 2.5Eth a chance but it’s the only one they will get as unique ownership will be high, which means secondary prices will be unaffordable for many. I’d prefer small WL allocation to certain communities at a lower mint cost, but it seems everything is set in stone now. What do you think? Also Pete…

Pete: This is just bananas by the way… I sold you on Toadzv and you sold me on Proof… seems like on balance you’re mentoring me!vi Also with Proof Collective passes where they are today, “affordability” is always going to be a very relative concept. Consider that Meebits are about 1/10th the price of Punks, and that MAYC is about 1/4 the price of BAYC, and we can see that 2.5 ETH is just waaayyyy too cheap no matter how you slice it with passes at 90++++ ETH!!!!1!! It seems to me a failure of anchoring and adjusting at this point. Like where did this magic 2.5 ETH number come from in the first place? The market clearing price is probably closer to 10 ETH at this point, which isn’t affordable to the newest of new participants, but would most likely be afforable-ish to anyone who’s been here for a few months and really wanted to bet hard on KRO. Also at 10 ETH, who the fuck is going to buy 20 of them? Maybe 10 people but not 500 people.vii Also the people buying at 10 ETH aren’t going to get some huge secondary market payday flip within the first hour (most likely) and are more likely to have a lower time preference for money (ie. investor vs. trader), and isn’t that what KRO et al. should be selecting for? A long-term community? Trying so hard to make the project “accessible” turns it into a short-term lottery ticket/charity for a few people, which is great and all, but those lottery winners are mostly just going to turn around and sell it to the long-term holders right away anyways.viii A few lottery winners will hold forever but not many, so I could see the logic in maybe 1000 raffle spot but the rest should be some combination of WL to certain communities, Dutch Auction starting at some crazy number no one will pay (like Tyler’s Incomplete Control starting at 500 ETH), and maybe even a little bit of botted cheap gas war. But why commit so heavily to just one strategy? Seems like mixing it up would be more interesting, more fun, and potentially more fair and profitable for everyone.

NFTier: I definitely hear you Pete! Given where the Proof pass is, a higher DA appears to make sense but I think that for sure would price out smaller wallets. Some people would just full-send at 10Eth, which might seem crazy but I think there’s just so much money in the space and coupled with Moonbird hype, it would definitely sell-out at that price. 2.5Eth gives a chance to a lot more people as a fixed price. My preferred method would most definitely be an Allowlist and I mentioned it countless times but I think they are also a bit limited on time to implement everything, especially considering most of the team has yet to be hired. So a raffle presents the most convenient way. Do you really think many people won’t buy say 20 birds above 10Eth? Do you have a buy price target in mind?

Pete: Buy target price for myself? Not really. Would have to feel the market out during the mint but anything under 7 ETH feels like a good buy I guess, which is why I’d like to see the DA start at like 100 ETH even and work its way down second-by-second, for at least part of the mint.

NFTier: Got it Pete. Yes I think 6-7 Eth is what I’m looking at as well. There are definitely ways this could have been done different, and for a project of this caliber, people were expecting something revolutionary. But it will not distract us from what they’ll build haha. And we’re getting two free birds!

With this new verified/whitelisted raffle mechanic, the chance of any of us minting ten Moonbirds just went to zero, but broader distribution will certainly result. The advantage of broader distribution is that holders of just one Ticket to Tinseltown will have a much harder time selling them since there’s no “alumni” category in the Discord or at upcoming in-person Proof events. The other benefit of the raffle mechanic is a stronger secondary market (MORE FOMO!), which a Dutch Auction definitely sucks the air out of by mopping up all of the available liquidity into the primary market (as Art Blocks so devastatingly demonstrated in Q4 2021). The amount of market momentum that can then be created by FOMO is not to be underestimated.

The disadvantage of having broader distribution is possible dilution of the quality of discourse within the community. Too much noise is a thing! As the Punks Discord discovered late last year when everyone piled in, quantity has a funny way of drowning out quality. Even when LL narrowed the chat down to just Punks and Meebits holders it was still too chaotic. The new Punks-only “Punks Lounge” hits the sweet spot today and is undeniably a large portion of the value proposition of Punks ownership at present.ix Smartly, even with Moonbirds, Proof Discord will still have a Proof Collective-only channel, which is where the creme-de-la-creme of conversation will continue to take place no matter what happens with Moonbirds auction mechanics.

At the end of the day, all minting and auction approaches have trade-offs, which is why I’d prefer to see a mix of approaches used to average out some of their respective side effects, but regardless, Moonbirds has captured an incredible number of our imaginations and we’ll all soon see a glorious tribute to the power of a meatspace network when applied to little 16-bit owl graphics.

This is only the beginning.

___ ___ ___

- Truth be told, Meebits (aka “LL3” pre-launch) hardly even had any hype leading up to the launch, there were only a few odd rumours floating around on Discord, not unlike the rumours of a Yuga Labs acquisition of Punks/Meebits, in the same surreal and only semi-believable way that very much precludes a mass armament of hot wallet ETH in preparation. This was no doubt because Larva Labs couldn’t market their way out of a paper bag.

Now compare humble LL with the mighty Kevin Rose (aka KRO)* to see who the real genius guerrilla marketer is. Indeed, KRO is right up there with Yuga Labs and Gary Vee. So no, Moonbirds isn’t really that comparable to Meebits, but you hopefully you get my point.

It doesn’t hurt that the whole space is 10x+ larger than it was in May 2021, but here we are still glued to the Punksian 10`000 PFP project size, wondering how to square all the weird circles we’ve created for ourselves.

___ ___

*I first heard about KRO not from Digg but from Hodinkee Talking Watches in 2014. Anyone else in the same boat? If so, you’ll know that dude collects, which is no doubt why he’s so goddam sharp at delivering value to his projects. His network is peerless, his patience is on point, and he just has this quiet power about him. Dude fuckin’ ships it! That’s why it’s so easy to bet on him, and why there’s a line-up out the door to give him 25`000 ETH ($USD 81 mn at prevailing rates) in exchange for a bunch of jpegs and access to a “private” Discord. It’s really pretty unbelievable. ↩ - Announcement article archived. Unlisted YT video. ↩

- Is a whole ETH on gas for a single tx really a thing these days? I’ve seen high gas prices but holy cramoly is that on another level. NGL that really would suck the fun out of it, especially if you lost that whole ETH and didn’t even get a mint. ↩

- Yes, that Murakami. ↩

- To all the people I Toad-pilled last fall – and there were a lot of you – I can but apologize in my typical Canadian way… but only for now! Y’see I also “pilled” a lot of people on BTC in 2013 at $200 before it “tanked” to $65 and stayed there all summer. Those things probably aren’t comparable!! But time will tell whether my Midas Touch continues. And to be fair, if you bought Toadz the day they dropped at 0.8 ETH floors and 5 ETH Toadenzas, you’re still laughing. Of course if you bought 15 ETH floors and 140 ETH Toadenzas a month after that, at least you can still !vibe ?

But there’s a few reasons that buying the top is the best trading strategy by a long-shot, 1) on the way up, it psychologically opens up white space for growth to the moon, and 2) even on the way back down, it can force you to lower your time preference for money since few of us have the intestinal fortitude to lock-in a 50-90% loss, even when that’s exactly what we’re showing on paper. We’re slightly more likely to dollar-cost-average (DCA) our initial investment, but we’re by far the most likely to hold the bag past the point of no return and either wait for it to go down to zero or moon many years down the road. But either way, buying the top encourages a certain sort of passivity required to be a good investor!

Obviously traders operate differently and have no issue taking losses (*cough*KBMMeebitSkelly*cough*) but that kind of mettle only comes from a professional background in trading. The rest of us amateurs (I mean INVESTORS) just ride shit off into the sunset when we’re down. The crazy this is that investing mostly works out too.

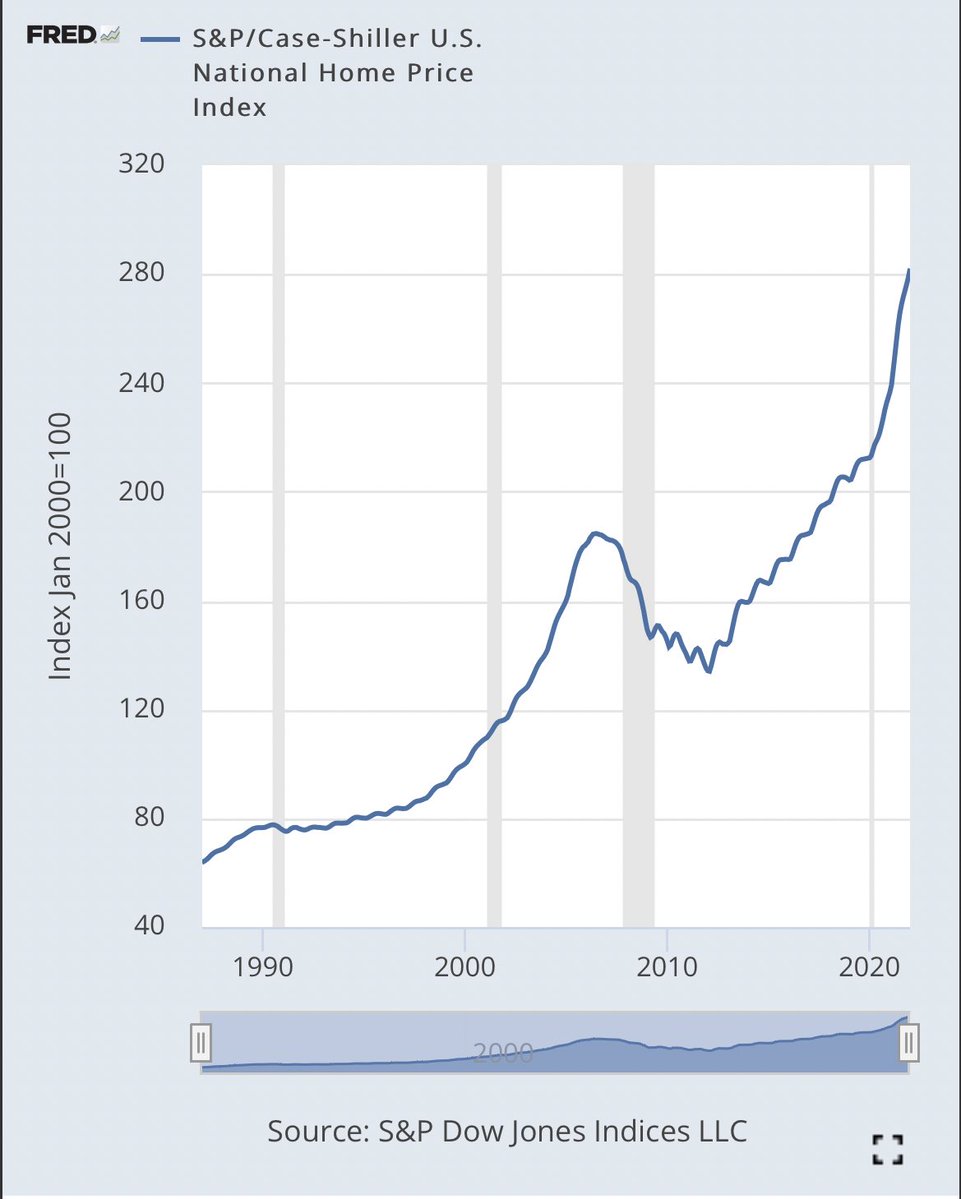

via Marc Andreessen. “Bubbles” all the way down amirite? ↩

- NFTier very sweetly asked me to “mentor” him in a Discord chat cold call about a year ago, back when we were both pretty new to the space. As you can tell, my much greater life experience hasn’t really translated into profitability to anything like the degree his youthful exuberance has, but he still puts up with me and we have really great conversations all the same! ↩

- Fewo’s recent paint drops thing is probably a decent comparison in terms of market impact and I think NG sold $20 mn worth in a day with 50 people spending about $160k+ each (call it 50+ ETH). ↩

- As we know, American “social mobility” is really just luck! It’s no surprise that the Moonbirds team is very American then eh? ↩

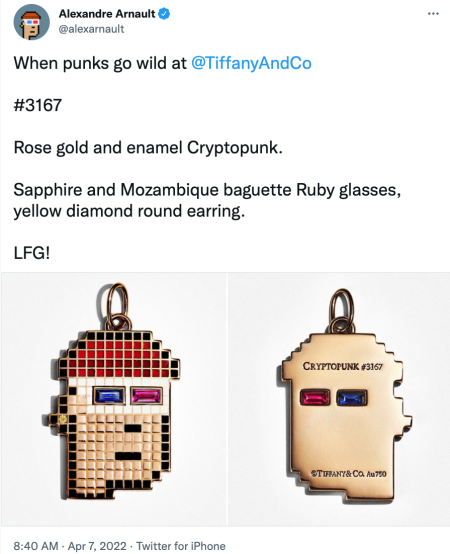

- The much smaller but still important part of Punks’ value proposition is LVMH suuugggaaarrrr:

Solid post. I’ve been wondering a lot about the “noise vs quality” concepts by allowing a broader distribution. You mentioned that the CP Lounge is the sweet spot – how many active participants are in there?

I did a similar analysis of the Moonbirds raffle a few days before they announced the winners, comparing it to Paradigm’s “Fair Mint” principles. Check it out: https://mirror.xyz/0x3740c62c535892705014B2c2ec1874418352952C/G33c0tRkziB7HVOwFJZmhZYZGyf6IMwx3sIhXNAOHtc

Quoting in relevant part:

First, as far as I can tell, there is no unexploitable fairness for the Moonbirds mint. Users sign-up for the PreMint.xyz allowlist and if selected, then you get to participate in the mint. Each person is limited to one Moonbird per wallet address. I believe this eliminates predatory sniping of the rarest items at the expense of less sophisticated users. But we’ll know more after reviewing the smart contracts underneath the mint.

Second, the Moonbirds Premint raffle meant no race conditions for participants. Sure, I hate waiting seven days to find out if I got a spot… But it feels pretty great that I’m not stuck in front of a device at a designated time, constantly reloading my device, inevitably crashing the site and clogging the network. (I’m having flashbacks of a drop gone terribly wrong on Parallel, the trading card game, where an off-chain pre-mint rush caused their web app to crash despite being protected by Cloudflare DDoS services!)

Third, the Moonbirds raffle means that the whole world can participate, highlighting elements of inclusivity. The alternative, picking any time for the drop, means that half of the world cannot realistically participate given time zones. I’ve been there, setting the alarm for 3:00 A.M. – only to get beat out by a bot.

Fourth, the Moonbirds raffle was gas efficient. I simply had to sign the transaction to prove my eligibility, rather than transferring the amount and potentially receiving a failed transaction that just wastes gas.

Fifth, the Moonbirds raffle ensures that the launch is open to a diverse base of holders. This Premint.xyz raffle for Moonbirds required 2.5 ETH per wallet, Twitter verification, and Discord verification, to prevent whales from registering multiple times. Not impossible to overcome these hurdles, of course, but significantly harder. Ultimately, a diverse base of holder is a good thing because “a vibrant community is what ultimately drives the value of a collection in secondary markets.” Id.

Sixth, the Premint.xyz launch mechanism may be trustless. According to Premint’s website copy, it “randomly select[s] the collectors and community members to win a spot.” I have not been able to confirm that they use a Chainlink VRF function, as it appears that the raffle occurs off-chain. Until I receive additional information from Premint, it appears you do require some trust assumptions here.

Great question. Not sure tbh. There are 270 verified Punks holders and 2 moderators but of course not all are active. Overall the channel is on the genteel side of things, which is a nice change of pace in this ADHD space.

Nice analysis. And in hindsight, the perceived fairness of the launch was absolutely incredible for the secondary market. A DA would’ve raised more capital for KRO but would’ve sucked the air of excitement out of the room, so the Premint raffle approach worked a charm. Not many projects can go 10x+ in a week AND HOLD IT so they clearly hit the bullseye. Bodes well for the future of the Moonbirds project that the team so clearly understands market/collector psychology.