In case you hadn’t noticed, the NFT market is booming. And for good reason!

Transacting within the crypto universe is fast, frictionless, and fun. The conventional art world, by comparison, is, well, slow, riddled with shipping delays, burdened by high transaction costs, and ok still fun but often not fun enough. Not to mention that, for many crypto-natives – present company obviously excluded – the conventional art world is downright intimidating.i And yet our social and metaphysical needs persist… because we’re still human.

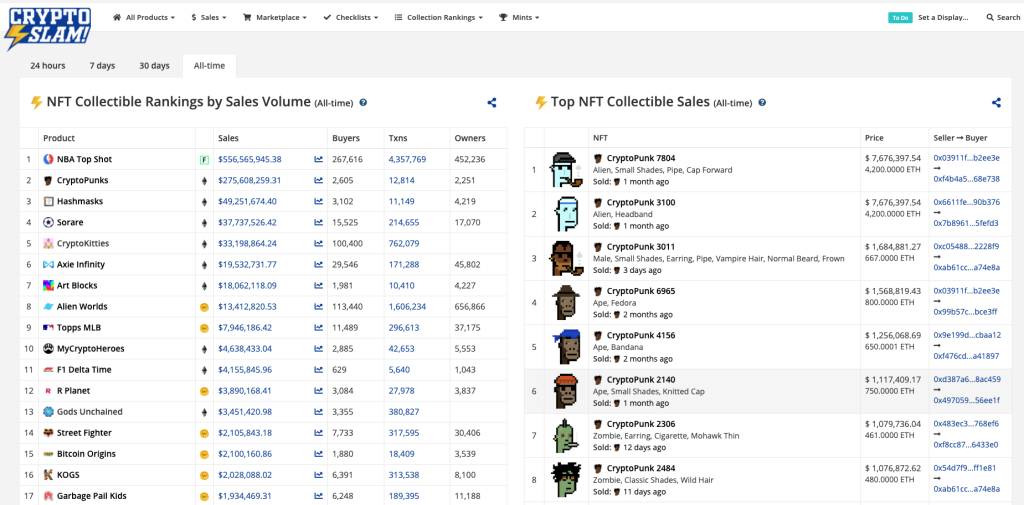

So as crypto-natives continue to take over the world with a combination of wealth and youth heretofore so biologically improbable as to border on the impossible, the interest of these crypto-arrivistes in “on-brand” art and collectibles is exploding right before our very eyes, very much in lock-step with this raging cyclical bull market. Unfortunately for the gatekeepers (and bag holders) of the ancien régime, the number of physical goods either interesting, investible,ii accessible, and readily available enough to soak up this energetic and highly liquid crypto-capital is in obvious decline. I mean, who wants to own real estate in the physical world when we can own it in the virtual world? Who wants to own physical streetwear when we can own virtual streetwear? Who wants to own physical art when we can own digital art? Who wants to own physical collectibles when we can own digital collectibles? Not the crypto-arrivistes, that’s for sure! So where will the surplus of crypto-capital flow to if not yachts, Monets, and Millies?

Well, to CryptoPunks, Autoglyphs, Beeples, XCOPYs, Fewociouses, and FVCKRENDERs, of course, as well as virtual real estate in CryptoVoxels, Somnium, and Decentraland, plus designer skins for avatars, not to mention a thousand other purely digital constructions not yet invented. The ability to not only create our own voluntary communities with our own internal logics and products, but also to financialise (eg. fractionalise, collateralise) our digital assets in a fast, frictionless,iii and fun way is an enormous part of what makes this new world so attractive, certainly compared to the decaying and devolving political and institutional landscape of meatspace.

So it is that as the value of crypto-capital continues to moon, pricing NFTs in ETH, for example, will matter more, not less. There’s a positive correlation between NFT pricing and crypto token pricing. The pricing of digitally native art in USD, CAD, EUR, or RUB will just make less and less sense within the context of the purely digital world as the disparity between the value of items in the physical realm shrinks in relative proportion to the value of items in the virtual realm, ultimately detaching past the point of reconciliation.iv

Therefore, that a floor punk will set you back 22 ETH today even though it only cost 1 ETH a year ago, all while the “USD value” of ETH went from $210 to $2`600 $2`700 $3`000 in the same span demonstrates pretty clearly that these new digital assets are not dollar-pegged, or that if they are, the dollar is in a whole lot worse of shape than anyone even knew. If anything, we can expect that the prices of digital items in digital token terms will continue to rise exponentially as the quantity and quality of physical goods interesting enough for the same money decreases.v

A corollary of this observation is that meatspace is on sale! BOGO baby! Basically, the fine art of yesteryear is… not out of reach anymore? And way less intimidating? Still, having space in our houses for fifteen Rothkos is unlikely but why not just one? Or maybe a Judd or Warhol?vi A few crypto-arrivistes are starting to figure this out, as James Tarmy recounts for Bloomberg:

Shortly after losing out on the auction for a $69.3 million digital artwork by Beeple, Justin Sun, a tech entrepreneur who founded the cryptocurrency platform Tron, contacted the Christie’s sales department looking for more NFT-connected artworks.

“The team in China was clever enough to say that we don’t have NFTs to offer, but has he seen this wonderful sale that’s just been announced in London?” says Giovanna Bertazzoni, vice-chairman of Christie’s 20th and 21st centuries department.

After perusing the sale, Bertazzoni says, Sun became intrigued in “some brand names like Picasso, Warhol, Basquiat, Renoir—those were relevant to him.” …

Sun was the purchaser, Bertazzoni says, of Pablo Picasso’s Femme nue couchée au collier (Marie-Thérèse) for £14.6 million (about $20 million), and Andy Warhol’s Three Self Portraits from 1986 for £1.5 million. Both paintings were sold during the auction house’s 20th Century evening sale, which was livestreamed from London on March 23.

Elsewhere, Snowfro is making moves:

In the same way that Vermeer, Goya, and Fragonard were “cheap” for Henry Clay Frick, and onyx sphinxes were “cheap” for Diocletian’s Palace in Split, so too are icons of 20th century art increasingly affordable in relative terms for crypto-arrivistes. Not that all are so keen in carrying the dead weight of the past, or in curating history through our new lens, as demonstrated by Matthew (@niftytime), as clear a bellwether of the shifting cultural landscape as anyone could ask for:

IRL me

I don't carry a wallet

I own one piece of art

I wear only a few outfitsMetaverse me

MM, Trust, Rainbow, Keychain, Temple, Wax Cloud

I own multiple museums (plural) of cryptoart

I update my CV avatar's wardrobe weekly— matthew (@niftytime) April 28, 2021

So are y’all ready for the new CADS? At least compared to the old cads, your women will be safe… we’re too busy with art.

___ ___ ___

- Just listen to Snowfro’s podcast conversation with Kevin Rose and listen to the dread in his voice as to the barriers faced by introverted nerdy kids in the conventional art world. Snowfro is no joke either, he founded the incredible generative art platform Artblocks.io and owns 10k+ ETH in CryptoPunks. He swings a big stick, but the gatekeepers and institutions of the ancien régime did a great job keeping him out of their stuffy galleries and art fairs. Their loss! ↩

- In crypto bull markets, everyone wants to make 10-100x in a year. Not even Yeezys and Pokemon cards can offer that, so what chance to Basquiats and Bentleys have? Any why not if it’s there to be had? ↩

- I really can’t stress enough how highly NFT markets (correctly!) value liquidity. Certainly crypto-markets in general understand the time preference theory of money intuitively enough, so it should come as no surprise that crypto-native investible art assets art highly liquid by design. This liquidity adds a tremendous amount of value. Probably 10x. And all of this newly created value is captured by the patrons! Disintermediating the gallery system, smart contracts cost no more than a few bucks in gas, rather than the 100% mark-up of galleries. ↩

- This is also to MP’s ancient observation that 1 BTC = 1 Haiti, give or take. ↩

- So don’t be surprised if a floor punk is >100 ETH in the next 24 months (ie. Spring 2023), regardless of whether ETH is $10k or $100k or more by then. ↩

- At least with NFTs, owners, their friends, and admirers of the work can enjoy seeing the art regardless of how small our homes are, unlike most ancien régime wealthy people who keep most their fine art sitting in climate-controlled freeports, never to be enjoyed by anyone. ↩