Gather ’round ye little ones, it’s time once again for us to look deep into the crystal ball. “But Pete, why now? We’re soooo busy making dat crazy $WIFi money!” Well Timmy, be that as it may, if we don’t take a step back now, once the euphoria really grips in the next few quarters, it’ll be too late to think clearly. So let’s take this relatively calm moment in the (left translated?) “Crypto Cycle”ii to reflect and look ahead.

Indeed, after a quiet couple years, with the Crypto Casino once again picking up steam and all kinds of dopamine-pumping niches working overtime to grab our attention with promises of piratical booty (and $TRUMPed-up treasure),iii it’s almost impossibly tempting to go ALL-IN right now. Once again nerds and gamblers (and especially gambling nerds) are starting to feel the early rush of victoriousness, and it’s the possibility of “up and to the right” is a hell of a drug. But as someone who’s been through 2 3 4 Cycles previously, perhaps I’m in the relatively unique position to ask: what does success even look like in the Crypto space?

This is an imperitive question to ask at a moment when the majority of our incentives are to Utility Maxx the shit out of this opportunity,iv which is to say marshmallow test ourselves because we can all see that the next 6-18 months are going to be MEGA BULL RUN and heaven forbid that we miss out another 2x, 20x, or even 200x from here, and in turn miss our chances of a lifetime to “Strike It Rich” and “Make FU Money”.v Just think of the guilt!

Unfortunately, a life optimised for guilt-minimisation is not a life of love, passion, wisdom, meaning, honour, or even any particular wealth. It’s not, so to speak, Choose Rich™.

Sam Bankman-Fried sentenced to 25 years…

I was NOT involved! pic.twitter.com/hXdHyHIavl

— NFTNick.eth (@allnick) March 28, 2024

“But why not, Pete? Isn’t the entire point of this giant on-the-nose ponzi economy to accumulate zeroes in our wallets? To HODL until the untermenschen fiat cucks kiss our feet? Like, isn’t that what Warren Buffet does? And isn’t he pretty happy, successful, and admired?” Well Timmy, not really! Because the hidden truth that’s at least a couple of layers of obfuscation away from the common man is that on the Choose Rich Pyramid™ the lowest level of aspiration is Capital,vi the intermediate level is Luxury,vii and the highest level is Power.

Another way to put it is that Choose Rich™ isn’t about having money so much as it’s about spending money (which is ironically also why even the most incompetent government bureaucracies are almost infinitely richer – read: More Powerful – than even the wealthiest individuals,viii and why their capture is sine qua non for deeper societal transformation).ix So is it any wonder that the most Power-thirsty next-gen in tech today are only too happy to promote and leverage Crypto, but only as a means to the end of accelerating AI? See: ELON + SAMA + SBF aka “Live Players.”

But why might this be so? Isn’t Crypto “revolutionary” or “reactionary” or “disruptive” or “innovative” or whatever? Possibly yes, but whereas Crypto is relatively narrowly constrained to the domains of Art + Finance, and can perhaps take credit for “bootstrapping” AI by incentivising GPU mining/development over the last decade, Artificial Intelligence has the potential to transform Institutions + Military + Manufacturing, id est that which ultimately decides the fate of humanity.

And I suppose this brings us around to one of my greatest concerns / critiques regarding Crypto at present: what kind of values are we even instilling in our “winners“? Because as far as your humble author can see, as it stands in 2024, Passivity is largely priviledged at the expense of Activity (ie. Agency). After all, this is a mega-high-beta space (not a high-alpha space),x and so we end up instilling relatively detached and excessively reductive values. Perhaps such is the tragicomedy of this high-beta Crypto space that it in turn creates betas.xi Indeed, we’re incentivised to think in terms of “pure numbers”xii and in doing so stay at the lower two levels of the Choose Rich Pyramid™ (Capital and Luxury),xiii leaving the highest offices of Power for those other guys.

I’m still mega-long digital assets, of course, principally because I don’t see a better risk-adjusted rate of return anywhere else in the world, certainly not one accessible to mere mortals, but I also no longer see the coherence nor the inevitable successfulness of the values that this space once held so dear.xiv And I don’t think I’m alone in this view either.xv Or do you suppose it’s a coincidence that actual industrial (ie. successful) societies like China and Europexvi are down-regulating Crypto to a significant degree?

So with all of this on the table, what’s does success really look like for the staunchest advocates of Crypto? Perhaps it’s just a good life and a bit of self-referential Soft Power. Maybe it’s not world-changing, but it’s probably at least up to the 3% Rulexvii for improvement. And maybe that’s just enough to surf the hurricane.

- $WIF is currently trading at USD $4.70, which will be fun to look back on in a few years one way or the other. ↩

- Don’t take my word for it, I’m not the Chart King! Take it from Bob Loukas in his latest video. Because in case anyone was wondering what “Left Translated Cycle” mean, it doesn’t actually map to “Supercycle” as I’d previously and incorrectly assumed. In fact it just means that we’re likely to see blow-off top in Crypto sooner rather than later (ie. late 2024) with a strong potential for a longer/deeper bear thereafter, as befits the broader 16-year-cycle that we’re coming towards the end of now. Bob gives this thesis a 60% probability. We shall see! ↩

- $TRUMP is currently trading at USD $3.82. ↩

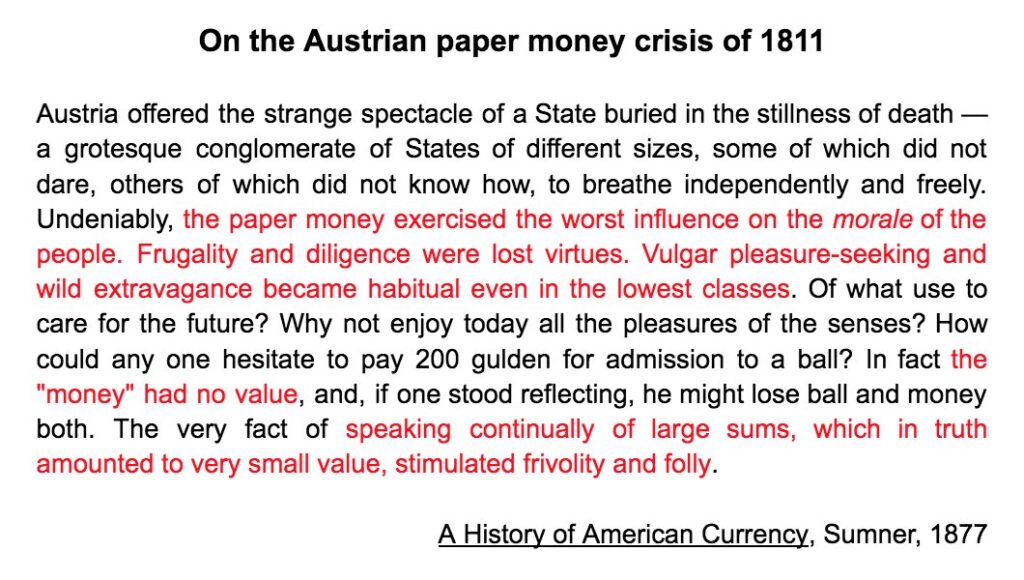

- Which may or may not be our faults for being born into the Fourth Turning / Fragmenting Nationlism moment we currently find ourselves in, at least not anymore than it was for the Napolean-ravaged Austrians two centuries ago:

- To quote the great poet:

Hail Mary culture,

Bowed heads commute.Egged for the fences,

HR FU,

Way-station NA,

Singles still doSirens sing promise,

Pitch extra sauce,

There is no try,

Do… or do not. - Yes, just Capital for its own sake, as exhibited by our pal Cypunk:

Yep, never got why people want to buy expensive cars… I mean, sure, if you're well off and really don't mind burning money, why not… but from capital management PoV doesn't make much sense. Maybe for collector items…

— cypunk.eth 🛡️🏴 (@FilmBrief) March 28, 2024

- As Ballas understood only too well. If only he understood inequality better! ↩

-

Having money doesn't make you influential. Spending it does. The biggest spenders aren't billionaires, but bureaucracies. It's not even close.

I think this is like *the* core fact of power in modern society that, if you don't have it, makes everything else incomprehensible.

— Marko Jukic (@mmjukic) March 12, 2024

- For those interested in politics and power in the modern age, it’s worth reading Samo Burja’s 2018 piece “How To Use Bureaucracies” (archived). ↩

- To quote Tascha at length:

It’s a waste of time looking for alpha in crypto.

While I brace for the incoming rotten eggs and tomatoes on this one, let me make it clear that you don’t need alpha to make money—as long as some preconditions are met.

But first let’s straighten out some vocabularies. What is alpha anyway?

If we hang our thoughts on the good old CAPM (capital asset pricing model) for a sec, the expected return on an asset consists of several parts:

Asset return = Risk free return + alpha + beta x ( Market return – Risk free return )

Risk-free-return is what you can be guaranteed to earn with eyes closed, e.g. interest on 10-year US Treasury bonds. Market-return is the expected return from the whole asset class— in this case, the crypto market.

Beta is the correlation of your bag of tokens to market movement. Since crypto isn’t an efficient market and all participants are here for the singular objective of watching numbers go up, you get extremely consensus price behaviors, i.e. everything goes up and down together (read: large and positive beta). Your sh*t coin holdings all have beta > 1. And almost no token has beta < 0.

Alpha is the portion of an asset’s return that’s uncorrelated to Market-return. A positive alpha is a rare breed in any market since it requires your holding to independently generate value regardless of what its industry, sector, or asset class is doing. It’s easy for anybody to name dozens if not hundreds of crypto tokens with negative alpha, i.e. they systematically destroy value in the long run. But I have yet to find anybody who can present a convincing case for a positive alpha for any of the myriad of tickers listed on any crypto exchange (hold your eggs and tomatoes for now, we’ll come back to this in a sec).

The closest thing I can think of akin to alpha generating in crypto are short-term pricing arbitrages, e.g. across exchanges and across a token and its derivatives. That would indeed shield you from much of the market directional risks. But two things here: 1) these aren’t an accessible game to most people and are by no means easy (with their own infrastructure, tech and execution risks), and 2) they become less profitable in bear market as liquidity goes down and risk of short-term extreme price dislocation goes up. So their returns are actually more correlated with market movement than you may think.

The bottomline is the crypto market I can see is characterized by very large positive beta and highly questionable, if any, alpha.

Influencers and gurus across social platforms and crypto chatrooms all claim to be discovering alpha, while in reality they are all just chasing higher beta.

And there’s nothing wrong with that.

Because if you know the characteristics of this market is as such, then your marching order is clearly laid out. Step 1, figure out if Market-return of the current period is positive. Step 2, if it is, then find a way to identify and buy the highest beta you can find. Step 3, do it over and over until Market-return turns negative.

Chasing beta is an easier and more profitable game in crypto than finding alpha because of how big and obvious the former is, as long as you do it thoughtfully.

That means developing two skills: #1, an ability to identify market cycle (not necessary to spot exact top and bottom, but in the ball park are we on the way up or down?). #2, a repeatable method to identify and execute on high beta plays.

Of the two, #1 is much more important than #2, because if you use a beta chasing method in an environment of negative Market-return, you’ll just perish faster.

In contrast, if you get #1 down, then #2 is the easier part. There are thousands of beta-seeking strategies out there across many different schools of investing, e.g. strategies of momentum and trend following, strategies of whale watching and order flow counting, strategies of pullback and dip-buy. All have their respective pros and cons. But as long as you pick something with a reasonable rationale and stick to it, you’ll be harnessing beta alright.

Of course the flip side is if you get too aggressive with surfing the beta highs without thinking through your downside scenarios, sooner or later the gods of risks will demand their tribute, that is, your head. And once Market-return turns negative, none of these strategies would be worth their subscription fees.

Now, let’s briefly return to the question of alpha. Again, a positive alpha is the portion of an asset’s return on top of the Risk-free-return that is uncorrelated with the underlining market. Where does it come from?

To answer that, it’s useful to look at where the so called Risk-free-return comes from. The 10-year US Treasury yield, a real world proxy for Risk-free-return, has a long-term average of close to 6% a year. Why 6%? Well, 3% average inflation + 3% average US real GDP growth = 6%.

In other words, the Risk-free-return is a proxy for the annual rate at which the economy as a whole is able to create additional real value-added.

So for an asset to have positive alpha, it needs to generate real value-added at a rate higher than the overall economy. And it needs to be able to do so for a longish stretch of time.

From this perspective you can easily see what kinds of assets will more likely to have higher alpha— leaders from high growth industries and sectors that will continue growing faster than overall economy for a long time— provided that you don’t buy them at too expensive a price.

I don’t want to argue with anybody on whether any crypto assets would fit this description. I have my views but I don’t have a crystal ball.

But there’s the thing. In considering capital allocation, one should not only consider the expected return on an asset, but also how it compares with alternatives, no?

We luckily are living in an age of many technology breakthroughs and demographic shifts that will change industries and economies profoundly in coming decades. If you want to find investments that will grow faster than overall economy for a long time, there is no shortage of likely places to look— artificial intelligence, renewable energies and transportation, healthcare, to name a few.

Even if one can make a case for why some crypto assets would have positive alpha in long run, whether that is a higher expected alpha than all these alternative—and arguably higher-likelihood— choices that you can sink money into, is an entirely different question. My answer to that is I don’t know. But given how strong a beta-driven market it is, I’m not sure that question is even worth answering.

- Betas that unironically call themselves “sovereign individuals.” Go figure. ↩

- From the forum:

emmy: Buying property doesn’t make sense from a pure numbers standpoint if you understand crypto. You can rent the big house and put the down payment and maintenance fees saved into Bitcoin. If you want to terraform the place, just let them take the security deposit. Rent forever. Thoughts?

Jiran: BTC is the new Real Estate. Appreciating hard asset. Back in the day house was same thing, buy it for 50k waatch it apperciate to 300k+. At this point homes are at such an insane top end plus the debt service of 6% means an extra $2-4M depending on mortage

and rent provides optionality to leave when you want also just repairs, maintenance, etc, it adds up. Let’s not forget property tax, etc and 100s of middle men for real estate that getting their grubby bumpkin fingers over the fees, realtors, brokers, title people.Pete: Couple thoughts: 1) A good life isn’t just about pure numbers or profit maxxing, in fact the best decisions from a quality of life perspective are often -EV. 2) The best areas to live in don’t necessarily have desirable houses for rent, so it’s either buy in the best areas and bite the bullet, or rent in a second (or third) rate neighbourhood. 3) Ownership provides optionality and stability, which are both very important for raising families and/or when planning to stay in the same city long-term. 4) Renovating, decorating, and making something your own, which happens a LOT more in a property you own vs. rent, is a lot of fun and not to be underestimated in personal value and of course social value (and yes, social value is a critical part of the why for being wealthy in the first place). For our young family there really weren’t valid rental options available in our city so buying made the most sense, so when we bought our first house 8 years ago, we bought an incredibly modest house that was wayyyyyy within our means allowing us to save as much BTC as possible. Now we’re about to close on our 2nd house and we couldn’t be more excited. It’s a huuuuge step up but still wayyyyy within our means, which is imo The Way ™️ when you’re actually planning to stay in the same city for a decade-plus, doubly so with youngins.

Mister Todd: I mean that can work all valid nothing worng but it is value systems to me. I moved a ton young until 31 10 towns from 18-31. Then never wanted to leave Raleigh + moved once here in 2011 to fook it that house. SO I’m not optimizing house as wealth tbh. fook, I got 150K / year to tax, insure, maintain the Urban Plantation. So I think the max-min wealth optimization isn’t the lens to own a house with. It is “other”. If you not yet in other — like Pete says then you don’t. Another way to think is mortgage. I dont have one for 12+ years. I “could” have bnorrowed at 2.75 and tried to optimize that ofc. this in a way is another version of what you are saying. I just dont want the hassle DGAF and have the hassle of a mortgage. CHOOSE RICH.

- Not unlike those in the “Developed World,” as it happens. Really, can you imagine a worldview more pacifying than imaging that we live in the “Developed World” and that it’s the rest of the world’s job to catch us, and for our jobs to do no more than lecture them on being “green”:

“Let me stop you right there…”

Caribbean nation Guyana is booming after discovering oil. BBC’s Stephen Sackur puts it to President @presidentaligy; lobbyists say oil is bad for the climate.

Dude wasn’t having it. Mans was ready! pic.twitter.com/awy8OPIW2q

— Ranga.🇿🇼 (@RangaMberi) March 29, 2024

- Though I suppose it can at least be said that Crypto is successfully ensuring the survival of both individual and group, which is more than the Bezzle can say… to quote MP:

Money has two aspects, which are in fact unrelated. On one hand, money is the instrument of ensuring one’s survival. You need money to pay the rent, and you need money to bail your idiot kid out of jail. This is all money, and any living being’s natural tendency to acquire the means of life guarantees everyone will be forever trying to get money. How much of it ? A lot. How much is a lot ? Shut up and count, Bernie.

On the other hand, money is also the instrument of ensuring a group’s survival, so to speak, through allocating resources back and forth. This is substantially different from that, much like cooking and eating are entirely different professions. You wouldn’t trust a theatrical critic to write you a play, nor would you trust a playwright to get very far in the newspaper columns with his butthurt ideas, would you ? Same here!

This is what the bezzle is : an attempt to separate the first from the second. Because it makes sense to try and somehow separate them, because they’re different things going different ways. Of course, there’s also a lot of danger in trying to separate them, because for some abyssal reason nobody groks they don’t seem to actually work apart. In that sense, an engine and a chassis are the components of all automobiles, be they cars planes trains submarines or anything else. Yet nobody to date has managed to build better automobiles by separating the chassis from the engine. Even if they are different things, and even if they are going different places.

- As Dave Nadig hints at in his recent article:

I’m skeptical that the lessons learned in the hyper-tribal, HODL, laser-eyes coinpumper community that has weathered countless winters are applicable to say, sound agricultural policy, or rebuilding the U.S. insurance system.

What lessons will they have learned, reinforced by the dopamine hit of having “been right”? That cult-like tribal dedication is rewarded? That everything in life can be divided into YOLO and HODL? That all that matters is how big a bag you can stash? That rules are for suckers?

That betting on the collapse of the now is a better use of their time and treasure than building or fixing the future?

- Having just returned from a full month in The Old Country, I can confirm that Marko nails it with his analysis of Europe’s surprisingly functional (if militarily underdeveloped) industry, economy, and yes even bureaucracy:

#EuropeanDynamism 🇪🇺 pic.twitter.com/MLuy2m5ELC

— Marko Jukic (@mmjukic) March 29, 2024

- Do you think it’s a coincidence that Virgil lived by the 3% rule?

A creative only has to add a 3% tweak to a pre-existing concept in order to generate a cultural contribution deemed innovative.

And if this is true in the arts, how much moreso in life? ↩