At this phase of the “Crypto Cycle“, all eyes seem directed towards Orange Coin: the energy-and-compute-backed super-asset more commonly known as “Bitcoin” and fanatically loved by many a laser-eyed young man.

At this phase of the “Crypto Cycle“, all eyes seem directed towards Orange Coin: the energy-and-compute-backed super-asset more commonly known as “Bitcoin” and fanatically loved by many a laser-eyed young man.

Long-time readers of these pages have understood since 2014 (as anyone with a pulse is figuring out in 2024) that Bitcoin’s meme is that of “digital gold” for the 21st century. But what is gold in the first place,i and why has it been so historically important, seemingly since time immemorial?

Author Jared Dillian sums it up nicely (emphasis added):

Gold has been called lots of things, like an inflation hedge. It is an imperfect inflation hedge, at best. It has been called a store of value, a disaster hedge–it has been called all sorts of things.

What it really is, is protection against debt monetization. What is debt monetization?

Debt monetization is when the government runs out-of-control deficits, interest rates skyrocket, and the central bank is asked to cap interest rates in response.

Rates are capped by the CB being willing to buy all available bonds at a given price. With printed money, of course. The money supply explodes, inflation skyrockets, and investors flock to hard assets, like gold, but also pretty much all commodities. There is plenty of historical precedent for this.

This is exactly what happened in the hyperinflationary episodes in Weimar Germany and Zimbabwe. Argentina is fighting it as we speak. Not to say that we’ll get a million percent inflation here, but even 9 percent inflation was pretty painful.

A government bond is a claim. It is a claim on some asset, and that asset is the productive abilities of all the citizens in the country. When the supply of claims exceeds the supply of assets, the result is inflation. This is the main reason gold is rallying right now–interest expense is spiraling out of control, and if interest rates tick up 1 or 2% higher, we will be in fiscal checkmate. The only path forward will be debt monetization.ii

Or do you think it’s an accident that our grandparents wore precious metal watches “just in case,” that Indians wear bangles “just in case,” and that even my 8-year-old son who’s never experienced hardship in his life “somehow” has a sixth seventh sense about the insurance policy against debt monetization (and the embodiment of eternal worth) that’s been represented by gold since… forever. Indeed, the same kid that started packing suitcases in March 2020 “just in case” has his spidey senses tingling again… and if that doesn’t make you want to load up on a couple kilos of the yellow stuff into a duffel bag (or better yet a couple billion sats on a paper wallet) I’m not sure what will.

Of course that’s the very pragmatic level! At the spiritual and philosophical level, gold has long been associated with loving-kindness, the sun, eternity, incorruptibility, divine worth, and alchemy (both physical and metaphysical).iii So no matter how you slice it, gold is here to stay.

In all its forms!

- Other than a very lovely and useful material for bespoke jewelry, that is. ↩

- Mr. Dillian continues, but just to keep things tidy upstairs:

So anything that increases the probability that we will monetize makes gold go up, and anything that decreases the probability that we will monetize makes gold go down. You’re probably noticed that rates and gold are now positively correlated. Why?

Because when interest rates go higher, it actually increases the probability of monetization. In a normal environment, high rates are bad for gold because gold yields nothing in comparison. Now, high rates are actually good for gold. Few understand this.

Gold responds to a number of different economic variables, but the one that it has the highest correlation to is budget deficits. When deficits are large (like 2009-2011), gold goes up. When deficits are small (like 2011-2016), gold goes down.

The one thing we know about the 2024 election is that no matter who gets elected, the deficit is likely to get even larger. Outside of some big disinflationary impulse, we are likely to get much higher rates. And if we get a war–Katy bar the door. There is historical precedent for that, too. The Fed pegged the yield curve during WWII, and after it lifted the peg, inflation went to high double digits. Gold was not freely floating at the time.

I have always thought debt monetization was possible since we started QE in 2008. And it’s worth talking about QE. How is QE different from monetization? With QE, you set aside a finite amount of money to buy bonds. With monetization, you set aside an infinite amount.

We’ve been inching closer to this for the last 16 years. Things always take longer than you think in finance, but I wouldn’t be surprised if we’re doing full-blown monetization in 2024-2028. That is the endgame.

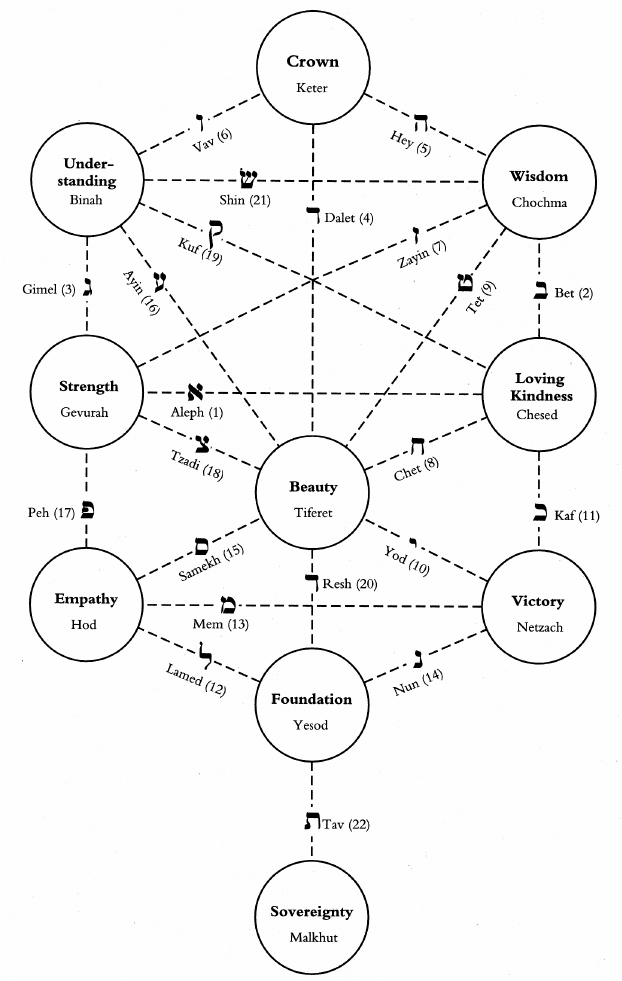

- From Kaballah:

Also from Kaballistic thought are the symbolic calculations of Gematria, which are the numerical values of each word that serve as hidden connections between seemingly disparate concepts. In the case of gold “זהב” (Zahav), its value is 14 (Zayin (ז) = 7, Hei (ה) = 5, Bet (ב) = 2), which is the same as that of King David (the fair-haired one), and is also the day of the month of Nissan that Passover (Pesach) starts, which is actually coming up next week! No wonder gold is puuuuumping atm:

From which we can caluclate that inflation has been running at 12-13% per annum for the last half-decade (if not 20%+ as measured in more consumptive goods), which Alan Greenspan circa 1966 told us was comin’!