The conversations, poking, and prodding continue,i as do our efforts to know not just ourselves but also our enemies, to wit, today we’ll consider another round of perspectives vis-a-vis the Dragon Panda.ii

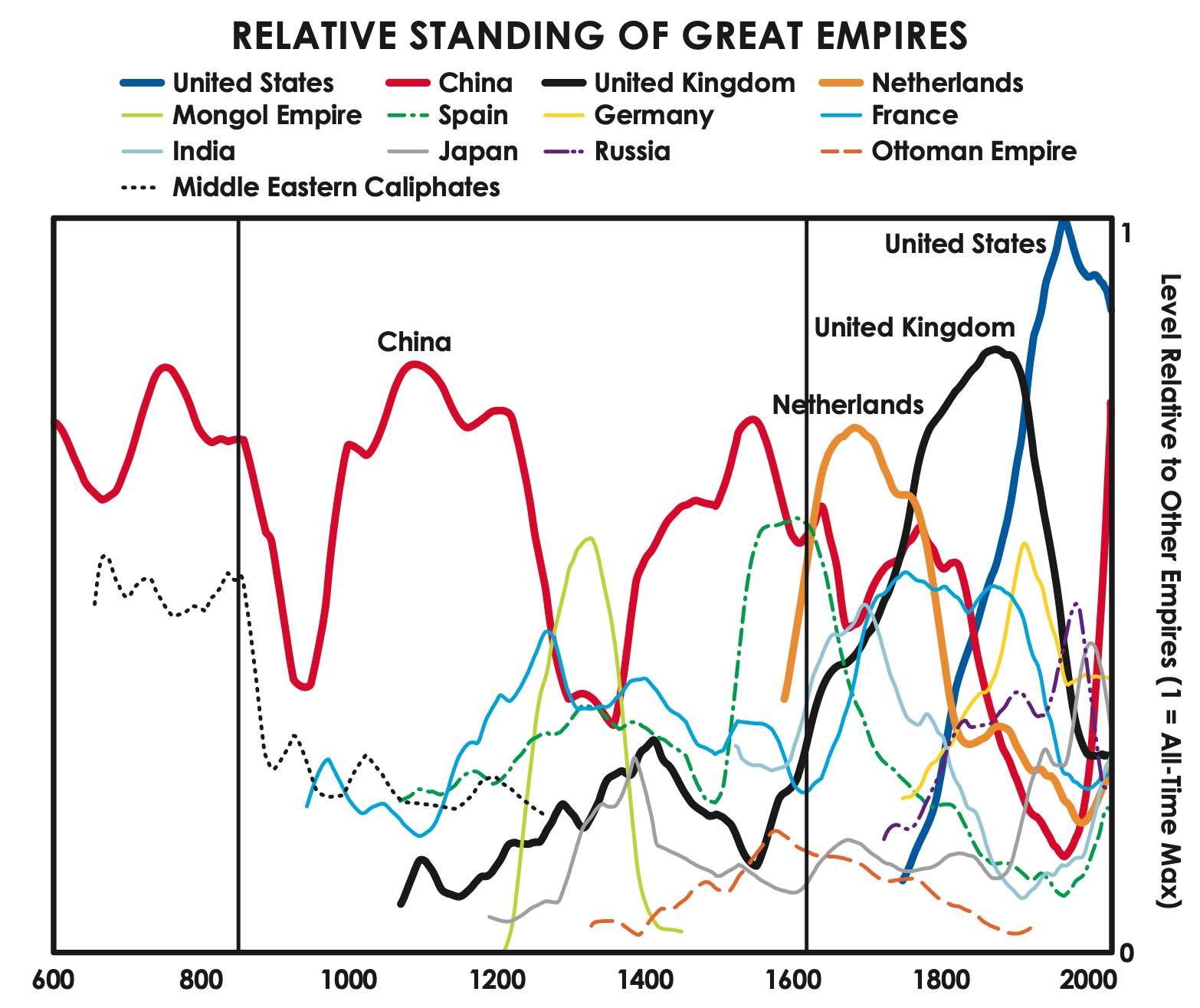

Peppering in a healthy amount of footnotes (like 30!!), let’s lead off with a few choice quotes from Ray-Daddy Dalio in his latest book.iii I mean, wouldja just look at that red rocket of a line in the last couple decades? You might almost call it hypersonic!iv

Dalio via LI:

I believe the current paradigm is a classic one that is characterized by the leading empire (the US) 1) spending a lot more money than it is earning and printing and taxing a lot, 2) having large wealth, values, and political gaps that are leading to significant internal conflict, and 3) being in decline relative to an emerging great power (China). The last time we saw this confluence of events was in the 1930-45 period, though the 1970-80 period was also analogous financially.v

Continues Ray-Daddy elsewhere:

Sorkin asked Dalio how he reconciles China’s human rights issues and the recent disappearances of high-profile citizens with investing in the country. “What they have is an autocratic system,” Dalio said. “As a top-down country … it’s kind of like a strict parent. They behave like a strict parent … That is their approach. We have our approach.”vi

Also from this side of the Pacific, Tyler Cowen opines:

The more dramatic developments have come from China itself. China did effectively wield state power to build infrastructure, manage its cities and boost economic growth. And most advocates of the Washington Consensus underestimated how well that process would go.

But along the way, China became addicted to state power. Whenever there was a problem in Chinese society, the government ran to the rescue.vii The most dramatic example was the extreme use of fiscal policy to forestall the 2008 financial crisis from spreading to China.

Yet this general application of state power, even if successful in a particular instance, brought a great danger: The Chinese were left with overdeveloped state-capacity muscles and underdeveloped civil-society capabilities. Over the last several years the Chinese government has done much to restrict civil society, free speech and religion within China. Now much of the world, including but not limited to China’s neighbors, is afraid of Chinese state power.

It is a mistake to view this fear as entirely separate from China’s development strategy. If a society relies on state power to solve its problems, that state will grow ever strongerviii — and the associated risks ever greater. With the benefit of hindsight, it’s hard not to think that China would be better off today if the Chinese state had remained weaker.

Now, because state power has its limits, it is difficult for China to solve many of its most fundamental problems. Chinese leaders are worried about the country’s low birth rate,ix for instance, but lifting restrictions on the number of children has not yet helped increase the birth rate. In many societies, it is religious families that have more children, but promoting religion is not a remedy that comes easily to China today. […]

For most of the last two decades, the prevailing view has been that, when it comes to economic development, history is on the side of Chinese model. It is unlikely that this view will prevail for the next two decades.

Then we have the latest perspective of the typically-incisive-but-still-very-human Samo Burja:x

Why do Chinese billionaires keep disappearing? By cracking down on industrialists, China hopes to make its economy more technocratic, but risks economic growth and the country’s political future.

Jack Ma, founder of Alibaba and China’s former richest man, is the highest profile businessperson to be “disappeared,” after criticizing China’s financial regulators and state banks in late 2020.xi Ma was reported missing before resurfacing in a few low profile events. Alibaba settled an antitrust investigation opened in the wake of Ma’s criticism with a record $2.8 billion fine.

Ant Group, the fintech company Ma wanted to spin off from Alibaba, had to suspend its IPO on personal orders of Xi Jinping before being forcibly restructured. Ma may not be detained, but other Chinese billionaires have not been so lucky. Some have been detained and released. Others have disappeared and even had their assets sold off. Former Anbang Insurance Group CEO Wu Xiaohui was sentenced to 18 years in prison in 2018.

There are various patterns of conflict: some are more clearly politically motivated, or harsher, than others. But all serve to make clear that the Party stands above industrialists. Under Xi, the Party’s ultimate goal is not economic growth, but social stability. This however presents something of a paradox.

Since the era of Deng Xiaoping, economic growth has been the lynchpin of Chinese social stability, with the necessary side effect of creating a new class of billionaires and industrialists.xii Cracking down on wealthy entrepreneurs and their business empires may mitigate against anti-competitive monopolies or financial crises. But it may also discourage the non-conformism and institutional foundings necessary to create new engines of economic growth.

Without growth, stability is threatened. The Party may need to turn to other sources of legitimacy, such as increased assertiveness abroad. How Xi and his peers thread this needle will have major implications for the economic & political futures of both China and the world.

Now let’s turn to a few perspectives from inside the belly of the beast, where we can notice not-to-subtle shifts, as we’d expect. Let’s not forget that China is the global factory and there really isn’t much that “our” “tech companies” can presently do about it, as Doug Guthrie, formerly of Apple University in China, observes when asked about the possibility of moving iPhone production to other countries:

Doug: Well, it’s a great question, Chris, and I think that there are three levels to the complexity of that relationship. I just think China has tremendous leverage. The first level, now I’ve heard leaders from Congress and the former president talk about like, “Well, companies like Apple should just move to Vietnam or move to India, it’ll all be fine.” But we don’t have the leverage that we think we do for these three reasons. First, is the floating population. There are 350 million people that are what we call “float” around the country, but they’re actually moved by the government.xiii This batch labor system is a tremendously powerful system in which the government moves people. The Chinese government moves people around the country to be at whatever factory needs them for seasonal production. This is amazing. It’s an amazing system.

And so, just having 350 million people, when people talk about like, “Well, we should just move our production to Vietnam.” Okay. There are 95 million people that live in Vietnam. The entire country couldn’t support what it is that is the production that’s happening in China. And there’s not a system for moving people around. The second thing is infrastructure that ties the system together. When people talk about, “Well, we should just move all our production to India.” India doesn’t have the infrastructure that links the states of India together the way China has developed.

China’s system of linking suppliers to final assembly factories, there’s nothing like it in the world. And then the third piece is what I like to refer to as industrial clusters. So many different cities in China have developed their entire system around focus on a very specific component or module. It’s just a system that has been developed in industrial development for the localities of China that I just think have made a dramatic difference. When you put those three things together, you can’t replicate this anywhere in the world. So it’s hard for me to imagine that a company like Apple or Tesla could leave China.xiv

From deeper still inside the bowels, we’d be remiss if we talked about China and didn’t quote at still further length from Dan Wang’s 2021 Letter, xv starting with a note of particular relevance to us crypto-enthusiasts and utopian universalists:

A willingness to assess foreign imports as well as a commitment to the physical world combine to make me suspect that Beijing will not be friendly towards the Metaverse. Already state media has expressed suspicion of the concept. If the Metaverse will exist in China, I expect it will be an extremely lame creation heavily policed by the Propaganda Department.xvi Xi’s speech on common prosperity in October noted that: “The rich and the poor in certain countries have become polarized with the collapse of the middle class. That has led to social disintegration, political polarization, and rampant populism.” The Metaverse, which represents yet another escape of American elites from the physical world, can only exacerbate social differences.xvii It is too much of a fun game, like cryptocurrencies, played by a small segment of the population, while the middle class dwells on more material concerns like paying for energy bills.xviii It might make sense for San Franciscans to retreat even further into a digital phantasm, given how grim it is to go outside there. But Xi will want Chinese to live in the physical world to make babies, make steel, and make semiconductors.xix

And speaking of the middle class, that which is so sorely neglected and abused in the west, Wang continues:

But Beijing’s control tendency isn’t the only story in this country. That spirit is resented by Shanghai and Shenzhen, which mediates it with their commercial tendencies. Pushback from local governments can occasionally mitigate Beijing’s worst ideas.xx Shanghai and Shenzhen are also sometimes able to help improve the institutional capacity in Beijing. The Chinese growth story is not simply produced by the government or by entrepreneurs. It is a heterogenous entity where different regions dialectically engage to obstruct and improve each other.

One can tell a story of stagnation in cultural production in China. And one is right to worry that the same will happen to the economy writ large. But we’re not quite there yet. The economy did not do well this year, but almost the entirety of the slowdown can be attributed to policy choices: either pandemic controls or regulatory tightening. Economists have said for years that China needs to deleverage its property-driven economy, and this year the leadership decided to do so. The central government embarked on this agenda because it has judged that its program of structural reforms will support growth in the medium to long term. It has certainly made mistakes, especially in the power market,xxi but the campaigns of this year display a willingness by Beijing to actively shape events. Ironically, it is these self-proclaimed Marxists who are willing to resist grand forces of history, for example in the cases of globalization or financialization.

The influence of Shanghai and Shenzhen are visible in the trajectory of economic improvement. First and foremost is the continued buildup of wealth, not just in big cities but also rural areas. Air quality has also substantially improved in Beijing and Shanghai over the last decade. The government of daily life has also gotten better. One can now obtain business licenses fairly straightforwardly; the intellectual property system has become robust, such that Chinese firms are bringing huge numbers of cases against each other; regulations tend to be relatively transparent and professional; and many types of risks are being squeezed out of the financial system. I submit that Chinese local government functions today would look fairly ordinary in any other advanced country. Outside of the security and propaganda apparatuses, government departments work as they would in the US or Europe, only with greater digitization.xxii

In more tangible matters, residents in Shanghai like to talk about improvements to city life that accelerated in only the last few years. The government keeps building new parks, bike trails, and commercial areas to improve the city’s already substantial livability. Chinese firms have not created many global brands, but I have confidence that will change. Entrepreneurs are still full of big dreams, having failed to receive the memo that globalization is dead.xxiii Those who sense foreign hostility towards China would keep their identity quiet, with the hope that the product quality will speak for itself. In segment after segment, I find that the quality of Chinese products has become strong. And I expect that good branding will follow good quality.xxiv

A metric of general quality improvement I like to use is the standardization of slow-casual chain restaurants. No, I’m not mostly eating out in the likes of Din Tai Fung. But chains featuring Sichuan sauerkraut fish and Shaanxi breads and meat are now plausible and even fun places to go to lunch. Anyone in food management can tell you that it’s hard to achieve a high degree of consistency across stores and across cities. That is something that Chinese managers have in recent years figured out. Although I’m pessimistic about the creation of Chinese cultural products, I acknowledge a possible exception in visual art. There’s energy in the art scene in Shanghai, driven by the buildout of new museums, a lack of established pieces to fill spaces, and curiosity among the public for new things. These are ideal conditions for art experimentation.xxv If anyone can push the art paradigm beyond displaying long-dead masters in a white cube, Chinese spaces are a good bet.

A lot of macro indicators on China are disappointing, like a rise in the amount of credit needed to create growth and a fall in total-factor productivity growth. But we can’t let these poorly-measured data points govern as the gospel truth to understand this economy. Figures must be reconciled with observations on the ground. During my time in Hong Kong, I found it absolutely hilarious to see annual rankings by think tanks giving the city-state the highest marks on economic freedom, while its business landscape has been static for decades. I submit that observers are making a mistake in the opposite direction when they use macro indicators to underrate dynamism in China.

China’s economy is in structural slowdown. But there’s still lots of catch-up growth available to a country with one-seventh the level of GDP per capita of the US.xxvi And there’s strong growth momentum in individual sectors, especially the science and technology fields that I spend my days studying. An American friend who sends his kids to school in Shanghai tells me that Chinese schools teach math the way that American schools teach sports: with the expectation that every child is capable. China’s semiconductor industry remains weak, but broader science efforts haven’t done too poorly. China’s space program, for example, might be years or decades behind NASA, but it has shown the capability to learn from past missions and take on increasingly difficult tasks. A steady capacity to execute on bigger and bigger projects also describes China’s energy infrastrastructure buildout. These produce the sort of national confidence to do hard things that the US had in the ‘50s and ‘60s.xxvii

For someone in the middle class, there has never been a better year to live in China. That comes down to the entrepreneurs, who are creating businesses to please people. They are not at all different, I submit, from their counterparts in the west. The control tendency of the government would every once in a while assert itself, which annoys entrepreneurs to no end. Their ability to push back has shrunk during Xi’s administration, but it has not completely disappeared. Every so often, they are able to tell Beijing to stuff it, through accepted administrative channels, for example in the case of excessive pandemic controls.

And the central government is itself keen for improvement as well. It has displayed a stronger record of reform than any other developing country, as the leadership keeps pulling off politically-difficult tasks: shrinking the state sector, re-orienting the economy towards export-led growth after WTO accession, and so on. One major question now is whether the central government still has the stamina to reform. After this summer, I think the answer is yes.xxviii

We have to avoid the triptych that outside observers perfected through the course of the pandemic. “There’s no way that China can control this problem at the start of the crisis; “These numbers aren’t real” during the crisis; and “It wasn’t that big of an accomplishment, and anyway authoritarian systems are perfectly suited to managing these situations” by the end of the crisis. China has strong entrepreneurs as well as a strong state, and these two sometimes reinforce each other. An interesting fact I noticed recently is that the party secretary of Zhejiang province, one of the country’s most important, used to be a director of China’s manned space program. A skim through the Wikipedia pages of provincial party secretaries would reveal a diverse range of technocratic experiences.xxix

An important factor in China’s reform program includes not only a willingness to reshape the strategic landscape—like promoting manufacturing over the internet—but also a discernment of which foreign trends to resist. These include excessive globalization and financialization. Beijing diagnosed the problems with financialization earlier than the US, where the problem is now endemic. The leadership is targeting a high level of manufacturing output, rejecting the notion of comparative advantage.xxx That static model constructed by economists with the aim of seducing undergrads has leaked out of the lecture hall and morphed into a political justification for only watching as American communities of engineering practice dissolved. And Beijing today looks prescient for having kept out the US social media companies that continuously infuriate their home government.

Then of course there’s the recently discussed, if rather muddy, sociological picture of tangping vs. neijuan vs. xiao xian rou (lying flat vs. involution vs. little fresh meat).

Confused yet? A little bit scared? Good. That means you’re learning. Because put it all together and what do we get?

- As they’re wont to do in the beautifully dark shadows of crypto bear markets… Whoops! Am I allowed to say that yet? Does that jinx something or other? ↩

- As Dan Wang notes in his 2021 Letter and a lover of marketing such as yours truly can’t help but corroborate, China sucks at sales, or at least its hilariously transparent. Not that it isn’t still in intimidating and worthy opponent, but that it pressures foreign writers to compare it to a cuddly panda rather than a fire-breathing dragon, as it does, is just a bit drôle. ↩

- Dalio’s Principles for Dealing With a Changing World Order was also the basis for last week’s introspection. ↩

- The joke of course being that the Chinese have hypersonic missiles now and the lardy tardy Amurricans… don’t. ↩

- Of course Dalio adds that bit about 1970-80 just so people DON’T PANIC. But let’s be real, this is like 1930-1945 in the west, or best case scenario, like 1975-1990 in the former USSR. ↩

- Should it come as any surprise that Dalio’s comments so closely mirrored those of MP from 2015? viz.

trinque: Indeed, seems they will try (and fail) to implement components of the republic in the style of massive government. “Look we’re going to centralize breathing. breathing is now banned; the central govt will breathe for you.”

pete_d: Seems nuts to us, then again, there’s a method to the Chinese madness or else they wouldn’t have ruled so much of the world for so much of modern history. And produced so many of the world’s greatest technologeeees.mircea_popescu: Yes. the method is : people are idiots and if you’re going to parent them, you gotta parent them.

Of course Dalio took a lot of “heat” for his comments from mouth-breathing pravda-ists in the west, but what else would we expect? ↩

- You mean the Chinese government ran to the rescue WITH SOMETHING OTHER THAN MONEY PRINTING??!?! Impossibru. I love Tyler but I sure hope he’s not becoming an apologist for American abuses and incompetencies in his old age. It’s not a good look, neither for him nor his beleaguered gerontocracy. ↩

- “If a patient relies on a doctor’s medicine to solve his problems, the doctor will grow ever stronger.” Seems an unsubstantiated arguments at the micro level, so why should it hold true at the macro? I’m hardly in favour of large coercive states for me and my family but I gotta side with Dalio here that it seems to be working just fine for the Chinese, and to the extent that anyone is running a successful “country” anymore, it’s gotta be them. So hey, if you’re going to do something, do it well, don’t just pay it lip service and call in the hard work, y’know? ↩

- Dude, fr, EVERYONE IS WORRIED ABOUT THEIR LOW BIRTH RATES. At this rate, Korea will be a fucking extinct peninsula in five generations. That almost certainly won’t happen, but only huge amounts of immigration from the fecund crescent of Africa and West Asia are keeping the western world humming along as well as it is. Elon Musk, the absolute king of playing long-term games with long-term people, wasn’t fucking kidding when he told WSJ that global under-population and subsequent population/civilisational collapse is a giant fucking problem looming on the horizon. Indeed, if China doesn’t figure its shit out on this front, we’re primed to see not one but two global superpowers implode this century, which may be simply too much for “civilisation” as we know it to handle. ↩

- Archived. ↩

- You can actually read Jack Ma’s Bund Finance Speech from October 2020 in English. His interest in developing big-data-backed micro-credit systems and his bullishness on cryptocurrencies were particularly interesting. ↩

- As Dan Wang notes in his clear-minded 2021 Letter, it’s not that “industrialists” are being targeted by Xi, it’s that the non-hard science and technology types are being kept in check so as to allow the “real” economy to blossom and bloom. To quote at unavoidable length:

While Beijing has restrained internet companies, it has done nothing to hurt more science-based industries like semiconductors and renewables. In fact, it has offered these industries tax breaks and other forms of political support. The 14th Five-Year Plan, for example, places far greater emphasis on science-based technologies than the internet. Thus one of the effects of Beijing’s squeeze has been prioritization of science-based technologies over the consumer internet industry. Far from being a generalized “tech” crackdown, the leadership continues to talk tirelessly about the value of science and technology.

In nearly all of my letters over the years, I’ve lamented the idea that consumer internet companies have taken over the idea of technological progress: “It’s entirely plausible that Facebook and Tencent might be net negative for technological developments. The apps they develop offer fun, productivity-dragging distractions; and the companies pull smart kids from R&D-intensive fields like materials science or semiconductor manufacturing, into ad optimization and game development.” I don’t think that Beijing’s primary goal is to reshuffle technological priorities. Instead, it is mostly a mix of a technocratic belief that reducing the power of platforms would help smaller companies as well as a desire to impose political control on big firms.

But there is also an ideological element that rejects consumer internet as the peak of technology. Beijing recognizes that internet platforms make not only a great deal of money, but also many social problems. Consider online tutoring. The Ministry of Education claims to have surveyed 700,000 parents before it declared that the sector can no longer make profit. What was the industry profiting from? In the government’s view, education companies have become adept at monetizing the status anxieties of parents: the Zhang family keeps feeling outspent by the Li family, and vice versa. In a similar theme, the leadership considers the peer-to-peer lending industry as well as Ant Financial to be sources of financial risks; and video games to be a source of social harm. These companies may be profitable, but entrepreneurial dynamism here is not a good thing.

Where does Beijing prefer dynamism? Science-based industries that serve strategic needs. Beijing, in other words, is trying to make semiconductors sexy again. One might reasonably question how dealing pain to users of chips (like consumer internet firms) might help the industry. I think that the focus should instead be on talent and capital allocation. If venture capitalists are mostly funding social networking companies, then they would be able to hire the best talent while denying them to chipmakers. That has arguably been the story in Silicon Valley over the last decade: Intel and Cisco were not quite able to compete for the best engineering talent with Facebook and Google. Beijing wants to change this calculation among domestic investors and students at Peking and Tsinghua.

Internet platforms aren’t the only industries under suspicion. Beijing is also falling out of love with finance. It looks unwilling to let the vagaries of the financial markets dictate the pace of technological investment, which in the US has favored the internet over chips. Beijing has regularly denounced the “disorderly expansion of capital,” and sometimes its “barbaric growth.” The attitude of business-school types is to arbitrage everything that can be arbitraged no matter whether it serves social goals. That was directly Chen Yun’s fear that opportunists care only about money. High profits therefore are not the right metric to assess online education, because the industry is preying on anxious parents while immiserating their children.

Beijing’s attitude marks a difference with capitalism as it’s practiced in the US. Over the last two decades, the major American growth stories have been Silicon Valley (consumer internet and software) on one coast and Wall Street (financialization) on the other. For good measure, I’ll throw in a rejection of capitalism as it is practiced in the UK as well. My line last year triggered so many Brits that I’ll use it again: “With its emphasis on manufacturing, (China) cannot be like the UK, which is so successful in the sounding-clever industries—television, journalism, finance, and universities—while seeing a falling share of R&D intensity and a global loss of standing among its largest firms.”

The Chinese leadership looks more longingly at Germany, with its high level of manufacturing backed by industry-leading Mittelstand firms. Thus Beijing prefers that the best talent in the country work in manufacturing sectors rather than consumer internet and finance. Personally, I think it has been a tragedy for the US that so many physics PhDs have gone to work in hedge funds and Silicon Valley. The problem is not that these opportunities pay so well, rather it is because manufacturing has offered dismal career prospects. I see the Chinese leadership as being relatively unconcerned with talent flow into consumer internet and finance; instead it is trying to fashion an economy in which the physics PhD can do physics, the marine biology student can do marine biology, and so on.

At this point I hesitate to add footnotes to quotes from footnotes of quotes, lest we get too Midrash-on-Midrash up in this hizzy, so I’ll just say that there’s considerable strategic value in actually making physical things in a resilient and under-optimised way, as China is. This should also make it unavoidably clear that the western world therefore only gets to be “green” and “climate-friendly” with our Chinese-made solar panels and Chinese-made batteries for as long as our daddy finds it economically convenient and politically expedient to manufacture such products. Because should he decide to make tiddlywinks instead, it’s game fucking ovie for that particular moralistic posture. ↩

- Lest you think that this “float” can’t be moved against Taiwan, or against the shores of California, you’re sorely mistaken. The manpower advantage that China has is simply staggering, to say the least, which is why the 21st century will be a lot less bloody if the US just concedes TMSC and has itself another civil war instead, ideally one that balkanises the continent. Of course decentralisation is not without its attendant trade-offs. The ability to mount a large army against would-be continental conquerers, and even to prevent foreign interference from pitting one balkanised micro-state against its neighbour, is obviously diminished, but Middle Ages Europe sorta managed just fine with such a state of affairs at a time during which, it must be noted, China was also the world’s great superpower. Sixteenth century, here we go again? ↩

- Isn’t the power to make things pretty incredible? It really makes you wonder where else economic and thus political power could actually be derived from. Ones and zeroes? Talking very loudly? The US had better hope so, because these certainly seem to be the baskets that they’re putting their eggs into. History is not on their side for this working out, but hey there’s a first time for everything. ↩

- Archived. ↩

- Sounds like a perfect fit for Zuck’s Meta! ↩

- Xi’s observation here ties very much into Bruno Maçães observation about the US becoming a virtual society. Perhaps the virtual world will link our balkanised archipelago of city-states in 2075? ↩

- Until everyone becomes a degen, which is on one hand its own kind of (unproductive) warrior class, but on the other hand robs Peter to pay Paul, but at least Paul is the boomer gen so who gives a fuck? ↩

- Two for three ain’t bad… but solving the lack of baby-making may well require invading neighbouring lands (Japan?) and planting a few seeds in the ground there, if you catch my drift. ↩

- This type of successful pushback against Beijing, however rare, is apparently non-zero, which only goes to show how non-monolithic everything is when we look a bit closer and take our all-too-convenient blinders off, particularly something with 1.3 bn people in it. ↩

- Beijing may have over-invested in coal plants but it seems to be making up for it with the construction of 150 new nuclear reactors in the next 15 years, which is more than the rest of the self-flagellating world managed to build in the last 35 years combined. Indeed, what have we to fear but fear itself? ↩

- Talk about leapfrogging! ↩

- “Globalisation is dead for thee but not for me,” the Chinese businessman might say. To the extent that we need what they have to keep us plump and comfortable, so it will be! ↩

- I’m not entirely convinced that good branding will follow from good quality, but I can see a “third way” wherein big-eyed westerners provide the marketingspeak and the industrious little fellows keep making better and better products, which isn’t even an imaginative future, being as it’s basically what we already have with everything from Omega to Peloton to Apple to Mercedes. ↩

- Ideal conditions for art experimentation are hunger and relative freedom. China definitely has the former, if in diminishing quantities, but does it have enough of the latter to make interesting and lasting artistic contributions? Whatever their elites bless will be representative of the zeitgeist, as art can only be, but muzzled art is typically more of a historical curiousity than part of any future canon. ↩

- That’s actually crazy to think that China is only ONE SEVENTH as rich as the US on a per capita basis. Basically, we shouldn’t be surprised if the Ascending Dragon is 2-3x larger in economic terms than the Declining Happy Meal in the next 50 years. ↩

- The golden age of the 50s and 60s in the west produced such tangible legacies as mid-century modern furniture, so one wonders what delights of enduring design will Chinese Modernism produce? ↩

- Compare, if you will, the running-on-fumes-istan of the west, which can’t even get its citizens enough masks, tests, or vaccines in a pandemic. ↩

- How strange it must be to not have a country run by lawyers and real estate moguls! For real though, imagine if Elon were in the US Cabinet. ↩

- Suck it Ricardo! What might work well at the individual level (contra Heinlein) turns out not to work out very well at the state level, fragilising as excessively narrow specialisation invariably is. ↩