From the chat:i

Pete D: If Moxsly keeps dropping the ETH price of his beautiful [Punk] Cowboy Ape to peg to USD (~$60mn)ii then it’ll be <3,000 ETH by the time ETH has its blow off top in a few months :Piii

Moxsly: I think ⬛⬛,⬛⬛⬛ ETH is as low as I’d take it, after taxes that’s like ⬛⬛,⬛⬛⬛ ETH remaining or so I believe – fair market value for a “floor ape” would probably be around 7-8k imo, so I’m still high relatively speaking. If we had an alien sale @ 35k before an ape sale I’d probably pop it back up to ⬛⬛,⬛⬛⬛ ETHiv

Pete: Haha I hear you, and I’m just teasing a bit. But I like your logic. Not that it’s anyone’s call but your own — we’re still talking about fairly staggering, pretty life-changing sums here!

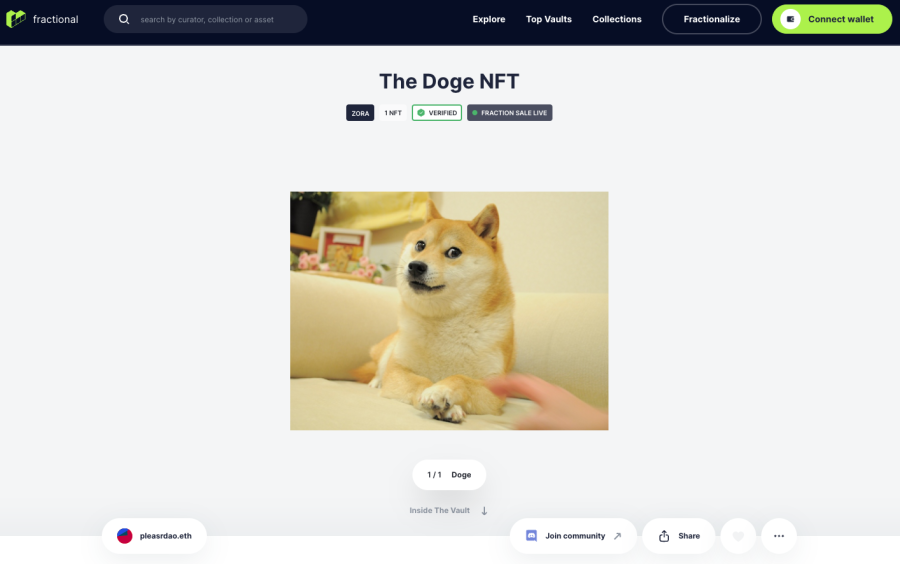

Mox: Yeah, that’s kind of where I’m at. I’m not an actual whale like most here, aside from in illiquid jpegs haha. – not to say I wouldn’t appreciate advice if there are good ideas to toss around. Aaron (from Flamingo) and I are going to talk about fractionalization, and legal implications. With the Doge NFT, it does show there is a lot of potential there. – I’ve wondered if I could use something like erc777 to embed a fractional token along with an erc721 token, which could be interesting.

Pete: I think the Doge NFTv is a fantastic example – perhaps the canonical example to date – of a big value “unlock” the likes of which we’ll see much more of in the next 3-5 years as that technology matures and the market figures out the best tools to maximize upside for all parties. Aaron is probably a great person to talk to, as I’m sure the PleasrDAO guys are. I don’t know how many more [Punk] Ape/Aliens we’ll see being bought outright before it’s all fractionalization but it might only be a small handful. The valuations will rightly get into the tens of thousands of ETH, likely even hundreds of thousands, so DAO/fractionalized ownership will kinda be the only way for even parts of them to trade hands imo, in the exact same way that no one can come along and buy ALL of Microsoft or Applevi anymore and must therefore settle for pieces of the pie of varying sizes… but of course this thesis is very much a work in progress.

Relatedly, my current thesis for these bluest of blue chip NFTs is that the marginal buyer of our (too large?) bags are past even being able to be bought by institutions of the ancien regime – those that 6529 warned us about – and are really only therefore appropriate acquisition targets for the upcoming generation of CZs, SBFs, Metakovans,vii Justin Suns, Brian Armstrongs, Shib kiddies,viii and the rest of the latter day crypto-native Rockefellers, Morgans, and Carnegies being minted seemingly daily by this rocket ship of a new economy.ix At least that’s likely to be true for outright wholesale purchases of these increasingly (and frankly obscenely) valuable assets. For investment funds, whether coming from the old world or the new world, fractionalised assets work better anyways from a risk management perspective. Not only does fractionalisation improve liquidity but it allows for broader distribution of a defined fund across a set of hedged investments, increasing the opportunities for more sophisticated trading strategies (eg. spread trades)x that in turn increase the available capital to the ecosystem by de-risking certain trades, thereby reducing interest rates and increasing the turns of leverage that lenders are willing to provide to market participants.

I know that my thesis of future NFT valuations differs from that of, for example, 4156, even though we happen to have nearly identical tastes (ie. bags — confirmation bias ftw) and that the post-merge deflationary environment of Eth2 will be different in as-yet-unknowable ways from the current inflationary regime, but I also see the space maturing beyond constrained relative valuations of monetary supply and into the wild world of possibility opened up by fractionalisation and derivatives, which we’re already starting to see the early faint glimmers of.xi So with these factors at more mature stages of development in the coming decade(s), the value of the art market on Ethereum could one day be, I dunno, maybe 50% of its total market cap?

Sure, that sounds completely batshit insane, but I mean, by way of a totally non-representative and non-transferable analogy, the greatest and most grandiose art patron of the last century – JP Morgan – died with an art collection valued at >$60`000`000 compared to a remaining estate of some $68`000`000xii and he wasn’t fractionalising shit. So if we call it round-numbers 50-50 for ol’ John Pierpont, and considering all the new weapons of decentralised finance at our current disposal, why couldn’t we expect 50% NFTs and 50% coins/cash allocation as an average personal benchmark for the new rock generation, and by extension whole chunks of the crypto-economy including even possibly the entire Ethereum chain?xiii

But hey, that’s just my crazy thesis… what’s yours?

___ ___ ___

- Which chat, you ask? IYKYK! ↩

- After the big [Punk] Ape sales on July 31st of this year, Moxsly (aka Straybits) listed his devilishly cavalier Cowboy Ape (#5577) for 25`000 ETH before adjusting the price a few more times, as high as 42`069 ETH, and as low as 12`800 ETH, before settling (for now) at 15`000 ETH.

Lest you think Mox is just fucking around and/or lost his marbles, why don’t you throw a WETH bid in and see? You might be surprised at just how far apart the two of you are, and just how much of a seller’s market that end of the market can be. ↩

- Because yes, this cycle ETH/USD will almost certainly blow past BTC/USD’s 2017 high. How? Why? Per Raoul Pal, it’s Metcalfe’s Law all the way down and ETH/USD today is actually almost identical to BTC/USD in 2017 when they had networks of similar size, except ETH is growing faster (because buidl > hodl, even if the world needs both) not to mention that apparently SOL is growing even faster still… but hey, so much for a single-chain-winner-take-all eh! ↩

- Exact figures redacted but hopefully you get the gist? ↩

- The Doge NFT is currently on Fractional.art with an implied valuation of 65,093.426 ETH ($310,669,661) (archived). It’s that culturally important! Apparently! ↩

- Or Saudi Aramco, etc etc. ↩

- I just did the math and hadn’t realised until now that Metakovan spent 42`329 ETH on Beeple’s First 5000 Days. Fuuuuuuuuuuuu ↩

- Archived. ↩

- There are indeed many historical eras for us to learn from as we try to anticipate how this new Crypto Era will unfold. At the very least, the 1870-1900 Gilded Age is one to learn from and Hamilton’s (~1770-1800) is another! ↩

- It appears increasingly popular to do a spread trade that’s long $GOOG/$MSFT and short $FB/$AAPL/$AMZN… for those that still bother with fiat equities lol. ↩

- uPUNKS or PUNK Floor anyone? ↩

- Figures per “The Proud Possessors” by Aline B. Saarinen (wife of legendary mid-century modern architect Eero Saarinen), published 1958 by Condé Nast. ↩

- Goodness knows there’s room for specialisation in the sea of blockchains, so maybe Eth’s leading value proposition going forward will primarily be art and collectibles, and that this will make up a disproportionate percentage of its chain value relative to the “art market” in the fiat economy. But this really begs the question, given that art is fundamentally power, what IS the proportional value of all

arttop-down power in the fiat world if we properly account for all propaganda – ie. news media, sports, entertainment, netflix, etc – as well as other pablums for and repressions against the masses – ie. fast food, walmart, mortgages, commuting, etc? Might it also be 50%? Or even more?From a related angle, to paraphrase Taleb, the three most addictive things in the world are cocaine, carbohydrates, and

a monthly paychequeflipping jpegs. Or did you seriously think our competitive advantage was just peacenik-y vibes? ↩

[…] Legacy: Good ol’ Johnny Pierpont was a hell of a collector, but because he didn’t have the foresight of mining magnate Solomon […]

[…] where Five Eyes was fractionalised and turned into micro-tradable ERC20 token, is dead and gone but the concept lives on. […]