We talked late last year about NFTs (non-fungible tokens)i vis-a-vis “digital art” and I’ve spent a fair bit of time since then thinking about the problem. What problem, you ask? The ICOesque buzz around NFTs these last few months was being taken all-too-seriously by fairly respectable investors (ie. Novogratz, Pomp, Chamath) but was still at odds with my conviction about the future of art.

Now, dear reader, I think I’ve squared the circle: NFTs aren’t art, they’re collectibles. And there’s a big difference between the two. To quote Brian Droitcour of Art in America:

How you understand the chimera of crypto art depends on your point of view. You can see the NFT as an expanded form of art that manifests concepts of value, ownership, and networked community. Or you can see it as an assertion of crypto’s worth, a financial asset valuable because of its uniqueness—a property it signals with a façade of art. Most people look at NFTs in this latter way. They were created as blockchain assets first. Art came later. Art is the rear guard of a movement led by Garbage Pail Kids and Pepe the Frog. Tokens bearing that kind of imagery are called collectibles, which are not quite the same as artworks. “Work”—and more specific terms like “painting” and “sculpture”—refer to what the artist does. “Collectible” tells you what a consumer can do with the product. Imagine if Hauser & Wirth announced a new drop of rare Nicole Eisenman collectibles. That’s the environment that digital art is stepping into.

CryptoKitties and CryptoPunksii are the next generation of Beanie Babies, which is totally fine, and leading sports-related platforms like NBA Top Shot are the next generation of sports trading card collectibles. And all the shit on SuperRare, Nifty Gateway, and, ahem, Christie’s? Ninety-nine-point-nine-nine-percent-flash-in-the-pan-junk that isn’t worth our time here today, unless of course any of it somehow manages to follow the blueprint set out herebelow by the early leader and undeniable eight-hundred pound gorilla in the space: NBA Top Shot by Dapper Labs. Here’s what makes the platform so special:iii

- The National Basketball Association (NBA) is the most politically engaged league in North American professional sports, and has yuuuuuuge (and increasingly individual) starpower to back it up.

- It offers the best elements of sports memorabilia, namely the association with our own memory of an athlete and a play (ie. “moment), with the larger-than-life celebrity of the athlete and the considerable marketing power of the league.

- It offers elements of the stock market – albeit of the digital variety with 24/7/365 trading, not the lame-ass fiat variety of yesteryear where statutory holidays in one unimportant global locale preclude business as usual in the rest of the world – with relatively high liquidity and fully transparent order book.

- It offers elements of cryptocurrency, if more than slightly in the ICOesque “crypto-flavoured” and “bitcoin-adjacent” sense of using a “blockchain” that’s frankly a lot more like Robinhood than full-fat Bitcoin. There is, manifestly, only one Bitcoin, the tree trunk from which all branches blossom, and while Top Shot accepts BTC, BCH, ETH, DAI, and USDC, it converts them to USD at the time of the transaction and keeps them stored as a “Dapper Balance” in USD forevermore. Still, transactions are recorded in a public and transparent manner on the FLOW blockchain, whatever that is.iv

- It offers elements of lotteries to create an addictive marketplace with regular “drops,” some of which can be pre-ordered but others that have to be signed up for live, and which, as far as I can tell, manage to keep out the kinds of bots that frustrate the shit out of anyone who’s ever tried to buy, say, tickets on Ticketmaster.

- Resolves issues of authenticity and scarcity by centralizing “moment” production and trickling in new users using the classic red velvet rope trick.v

- Resolves issues of grading by making all assets purely digital, which is perhaps the most deeply underrated benefit of the whole experiment because grading is to playing cards as provenance is to fine art – hugely political – and when code replaces politics, users win!

So what does all this mean for you and me?

It depends on how messed up your childhood was (ie. how much collectionner you need to feel like a whole human being), how much of a gambler you are (it’s not an investment!), how much of a sports addict you are, how novelty seeking you are, and how much your cool friends are already into it.

The platform is a lot of fun! And the NBA isn’t going anywhere anytime soon, so the downside risk related to your typical crypto exit scam feels pretty remote.vi With the number of potential users for this platform well into the hundreds of millions and with only a couple hundred thousand on there now, it feels like we’re at the start of something pretty big.vii That being said, the total addressable market of sports collectibles is relatively small, like $5-10 bn/year compared to $60-70 bn/year for the fine art market, but the value of all fine art extant is, like, 100x that number? Whereas sports memorabilia is maybe 10x that annual figure because it’s mostly based on North American sports from the last hundred years whereas fine art (including “anthropological” artifacts) is global and millennia old, so we’re talking about, say, $0.1 tn vs. $7 tn TAM, so nearly two orders of magnitude difference. This isn’t to say that NFTs won’t take a huge chunk of these two markets over the next 10-20 years, but I’m betting on them taking a much, much larger percentage of the sports collectibles market in general and trading cards in particular.

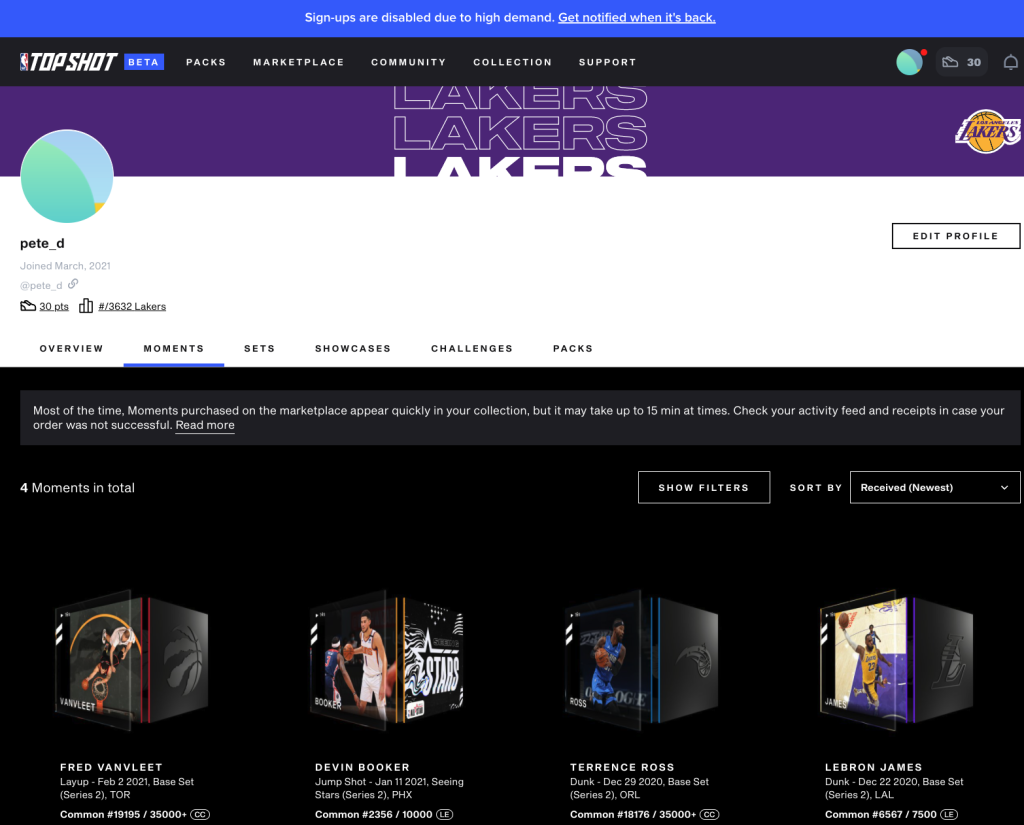

In case you’re wondering, here’s what a very small toe in this new world looks like:

Take it to the rim!

___ ___ ___

- NFTs are the virtual successors to coloured coins, namecoin, etc. They aren’t a new idea by any stretch of the imagination, but the newest generation uses proof-of-stake-based blockchains to keep transaction costs manageable and everything “fair,” even if early adopters are still handsomely rewarded, because why wouldn’t they be? ↩

- 650 ETH for CryptoPunk 4156 (archived) shows that Ether really should be worth 1/5000th of a bitcoin. ↩

- Even though NBA Top Shot is only in Beta and doesn’t even have basic social functions like being able to follow other collectors, it’s still head and shoulders above the rest in terms of user experience, product, marketing, and future potential. ↩

- In defence of NFT platform SuperRare (and others? maybe?) they price their “digital art” in Ethereum, which is still obviously nowhere near as cool as bitcoin, but is at least a step in the right direction away from USD denominated everything. That being said, from an ownership perspective, “owning” an NFT on any of these platforms is not quite as simple as it might appear. To quote Michael Connor at Rhizome:

The model of art ownership implied by NFTs has been a matter of some debate, and here, too, a comparison is instructive. Crucially, all of the imagery associated with all generations of CryptoKitties remained under the copyright of the developers. This definition of ownership was not specified in the ERC-721 standard itself; it’s found in a separate license that governed the use of the app: “you own the underlying NFT completely. This means that you have the right to trade your NFT, sell it, or give it away.” But, “your purchase of a CryptoKitty, whether via the App or otherwise, does not give you any rights or licenses in or to the Dapper Materials (including, without limitation, our copyright in and to the associated Art) other than those expressly contained in these Terms.”

It’s a generous license that allows users to have a broad range of rights to use their Kitties publicly, but given the recent debates about what it means to own an NFT artwork, this is a really important precedent: in the view of the makers of CryptoKitties, the NFT itself did not offer a general definition of what it meant to “own” a work, or what rights rested with creators.

The implication of all of this is what it means to own an artwork governed by an NFT is not some settled fact. Ownership needs be defined alongside the sale of an NFT, via a standard contract, or another kind of smart contract (Zora is one example of a marketplace that is doing interesting work in this area). I’d argue that even just an email or handshake agreement would help, because most art sale contracts are only ever used to clarify expectations and prevent misunderstandings, even if they aren’t bulletproof legal documents. This is actually an area where ERC-721 took a step backward from McCoy and Dash’s concept—in the standard demonstrated in that 2014 transaction, there was space for a (linked) legal and (embedded) plain English definition of ownership. […]

At Rhizome, we’ve found that immutability is not necessarily beneficial to the long-term stewardship of digital art. Histories need to be rewritten, artists change genders and names, authorship conflicts emerge years after a work is originally published. On the technical level, there is also a need for dynamic approaches to stewardship: resources external to the artwork get lost or deprecated and need to be reconstructed, and artworks need to be moved in between ever-changing, in many cases highly proprietary software environments that even might or might not support certain encryption algorithms. We’ve also found that blockchain-based preservation projects can themselves require external support in order to maintain ongoing access to the interfaces to their records and contracts.

- We really can’t underestimate that importance of velvet rope-style “artificial scarcity” in a world run amok with artificial abundance. Richard Mille and Rolex are the blueprints in the physical collectibles world. ↩

- Even if the FLOW blockchain turns out to be easily hackable and/or the fees get out of control, Vancouver-based Dapper Labs can switch over to another chain anytime with minimal hassle. The blockchain element of this experiment is pretty much besides the point. ↩

- We don’t even have bloopers yet! Just wait!!! ↩

Updated with a spot of history in footnote i, just in case any yungins are reading quietly at home.