While nowhere near as intellectually grounded, utopianly dreamy, far-sighted, geeky, nor globally relevant as Bitcoin, the latest routi of Citroen Citron Research and Marvin Melvin Capital by /r/WallStreetBets vis-a-vis GameStop stock was one of the most thoroughly satisfying man-against-the-machine wagers-cum-wars to come out of left field since the halcyon days of 2013 when I was first getting my beak wet with “cryptocurrencies.”

The meme-powered hilariousnessii that ensued over the past few days was almost out of Elon Musk’s playbook,iii and very much as grounded in tradition while as apparently unorthodox on the surface. What do I mean here? Let’s dig in a bit deeper into what happened this past week with $GME and what is

The meme-powered hilariousnessii that ensued over the past few days was almost out of Elon Musk’s playbook,iii and very much as grounded in tradition while as apparently unorthodox on the surface. What do I mean here? Let’s dig in a bit deeper into what happened this past week with $GME and what is teaches reminds us about fiat finance.

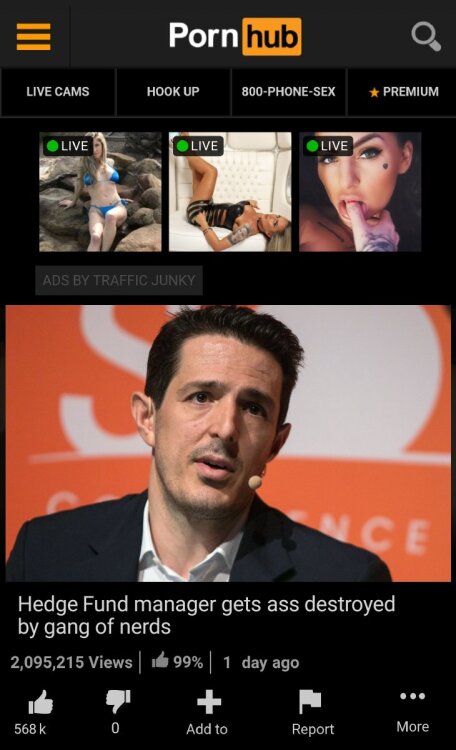

You see, WSB redditors rightly enough wanted to thumb their noses and take their pounds of flesh from the evil bankers who were largely responsible for ruining so many lives in 2008 and yet were bailed out with taxpayer dough.iv WSB users correctly identified a company in the midst of a turnaround with a stock that was massively over-shorted (140% of outstanding stock)v and proceeded to coordinate a bottom-up “Joes vs. Pros”vi short/gamma-squeeze with all the ferocity and vengefulness of a woman scorned.

Unfortunately for the WSB crowd – funny and even erudite at times though they were – they elected to narrowly restrict their activities to the confines of the fiat stock markets more broadly using a US market app called “Robinhood” more specifically,vii ie. the stomping grounds dominated and controlled from top-to-bottom by the same fat cats they aimed to dethrone.viii This was a strategic error, the type that redditors have too long been known for, even though these kids – some of whom were actually doing their homework at the same level as the hedge funds they attacked – should be applauded for sharing critical information in a way otherwise only accessible to “idea dinners” in Manhattan, all while cheekily calling each other “autistic degenerates” and “degenerate gamblers” while dipping “chicken tendies” in champagne. It was kinda fucking golden in a very YOLO right before a deadly car crash kinda way.ix And of course some of them stacked shedloads of skrill along the way, but any debate about who ultimately has the upper hand in this structurally disadvantaging game has been put to rest.

You might say that the fight isn’t over yet – that the Joes aren’t done punching the Pros below the waist – but Robinhood and their client Citadel have now demonstrated that they’re willing to go to incredible lengths to protect themselves, even if only for one day more, while sacrificing their users because their users are not their clients for as long as Robinhood is “free.”x The fight will continue, but rather than WSB leading the way, it’s decentralised weapons like Bitcoin,xi strong encryption, and non-platformed media that will increasingly demonstrate disruptive returns. This won’t play out overnight. This story will unfold over the next 20-30 years as the analog bubble deflates (and no, the analog bubble won’t pop completely – there’s no end to anything).xii

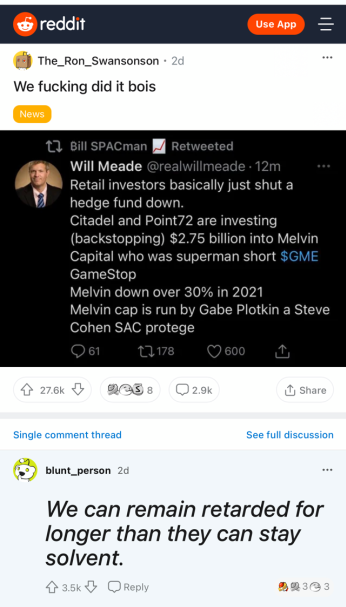

What we can say about this evolving WSB/GME saga is that it’s another clearly symbolic event in the intergenerational conflict that’s underway right now; a conflict spurred by anxious resentment that’s only been exacerbated by COVID lockdowns eviscerating the already beleaguered and indebted Millennial/GenZ working class while handsomely rewarding SilentGen/BabyBoomer/GenX equities investors. So it is that “We can remain retarded for longer than they can stay solvent” is actually closer in spirit to poster boards with “We are the 99%” or facemasks emblazoned with “I can’t breathe, please stop” than we might initially think. There’s change afoot. We’re in the thick of it. There are wrongs that must be righted.

And shit’s about to get retarded.

___ ___ ___

- According to S3 Partners analysis, bearish investors who took short positions on $GME have already lost $70 billion in 2021 on this single position. That’s $3.68 bn in losses per trading day this year! ↩

- Here are a couple of my other faves:

Fuck Yellen. Also:

- Speaking of Elon, did anyone else see his support for Bitcoin coming so soon? ↩

- Speaking of bailouts, to quote relevantly from my nearly-forgotten 2015 article entitled “Bankers aren’t the bad guys“:

The crazy part about this isn’t that bankers still have the gall to keep company with the living and that you’re on the hook for their champagne-fueled benders in Monaco while they do, the crazy part is that generation after generation, you believe governments that, after creating a situation where private financiers are bullied into becoming instruments of the state at your behest, pits you against said financiers and encourage citizens to take up arms to maintain their “dignity.”

Time after time, whether Hitler’s Germany or Portillo’s Mexico or William III’s England, governments throughout history have squeezed financiers six ways to Sunday in an effort to achieve their objective of staying in power as long as possible, which means using the weapons of finance to fund the continued operations of those in the government’s inner circle, and occasionally to throw a bone to “the people.”

As ever, “the people” are happy to be along for the ride, so susceptible are they to emotional arguments and so confused are they by the magical dragon powers of the true 0.01% (and others that are close enough, namely the other 0.99% at the top), that financiers, jooz, etc. are perfectly acceptable scapegoats when the kitty runs dry and a little more squeeze need be applied. Hey, anything works as long as the masses don’t have to address their own failures or those of their corrupt leaders.

I don’t think I’d be quite as callous today about the failures of the masses as I was back then – I’d like to think I’m more sympathetic now, or perhaps just more agnostic and a tinge more merciful – and I’d probably use the possessive determiner “our” instead of “your”, but hey, footnote xii is a thing: in the world, but not of it yo! Plus, what’s the point of this fucking blog thing if I can’t disagree (or agree) with the world, including the parts I myself have left behind? These essays and memoirs scattered across the interwebs owe me at least that much. ↩

- As of this writing, short interest is still 113.31% of float according to S3 Shortsight via isthesqueezesquoze.com ↩

- Many other hedge funds came rushing in to follow the retail-led momentum, which no doubt magnified the size and scale of the squeeze, but were those johnny-come-lately hedge funds punished by Robinhood/Citadel? Ya not so much. ↩

- No, reddit’s “retaliatory” pumping of Dogecoin from $0.02 to $0.07 on Thursday didn’t count. Doge isn’t a thing! Which is why it’s back below $0.03 as of Saturday night. ↩

- In case you’re wondering, no, I didn’t momentum trade with WSB et al. nor do I have plans to (I’m actually not much of a trader). But that doesn’t mean that I don’t appreciate a good lulz-fueled rally! Bitcoin used to have a much better sense of humour back in the day and this week was another glimpse of that, as was $GME going up double-digits (even triple-digits) several days in a row. It’s not often you see that in markets and it’s a beautiful thing to behold! ↩

- To quote “Rabbi” Matt Levine:

Here is a YOLO story, a story of utter nihilism. You know this story. This story is perhaps best told with a series of rocket emojis, but let’s try words instead. The people on the WallStreetBets subreddit sometimes all get into a stock at once. This is fun, a nice social outing in an age of social distancing, a risky but potentially lucrative collective entertainment. Recently they decided to do GameStop. Because, I don’t know, they’re gamers, or because it’s a little comical to pump the stock of a chain of mall video-game stores during a pandemic, or because a lot of professional investors are short GameStop and they thought it’d be funny to mess with them. Or, especially, because their friends on Reddit were buying GameStop and they figured they’d join in the fun. Or all of those things in different combinations. Take one person who’s long for fundamental reasons, add 100 people who are long for personal-amusement reasons like “lol gaming” or “let’s mess with the shorts,” and then add thousands more who are long because they see everyone else long, and the stock moves

- This of course ties back into the ancient observation in networked tech that “if you’re not paying for the product, you ARE the product.” Apparently this lesson has to be relearned every 3-5 years by another generation of whippersnappers.

With Robinhood, the buy/call side was nixed on Thursday while the sell/put side was left open, allowing the stock price to retreat 44% while Citadel and their cronies reloaded on cheaper shares. Robinhood found themselves short on liquidity at the time but instead of preventing new users from flooding into the doors, or even just shutting down their app entirely while they got their fucking shit together, they kept the chumpatron churning and in doing so caused a train wreck that not only wiped out hundreds of millions and perhaps even billions of dollars of user profits, but also exposed themselves to an enormous class-action lawsuit that will almost certainly destroy at least half of their $11.2 bn private market valuation. Sucks eh! ↩

- From what I’ve seen, and as these pages attest, Bitcoin doesn’t punch below the waist, it decapitates. That’s kind of a big difference when you’re waging war against the machine.

Still, goodness knows bitcoin-based exchanges are far from perfect, and I don’t just mean the fiat-to-bitcoin ones either because Mt. Gox and QuadrigaCX are sadly more the norm than the exception, but even things like MPEx are long gone, and BitFunder et al. are an equally distant memory, but the foundations are there, ready and waiting for the near-mythical “hard people” to emerge. ↩

- Everything is a bubble. The question is how big it is and how long it can last. Spake Rabbi Zohar Atkins:

Value depends on time-horizon.

If you take the long view, GameStop is over-valued.

But, stretched over a century or a millennium, most of us don’t get to see the GameStops schemes exposed—we live in bubbles, and to reject them on that basis is to lose, to be naive. For in the short term, they are valuable. If you short something valueless prematurely, you lose.

This is perhaps a way of saying that in the long-run naturalism (realism) wins out against positivism (nominalism), but in the short-run, which is all we have, positivism wins.

This tension is even reflected in Jewish law in myriad ways.

One example: Before Passover, Jews burn their leavened bread and pronounce that any leavened bread in their possession should be considered as dust of the earth. And yet the pronunciation—which alters the legal status of crumbs—doesn’t change the chemical fact that they are crumbs.

We’d be fools to go and search for crumbs after we’ve done the ritual—and yet the embarrassing fact remains, what if we should find a crumb we’ve pronounced non-existent on Passover? According to realists, we’re in trouble. According to positivists or nominalists, we’re fine. Value is whatever we say it is. In the nominalist paradigm, on which I’ve written before, all value is manipulated.

Life is one big metaphysical short squeeze. The question is what do you do with that information? Knowing that the bubble may not pop in your lifetime, knowing that it may be profitable to accept the bubble rather than poke or challenge it, what do you do? Is this the meaning of the ancient teaching that we should be “in the world, but not of it?”