Gentlemen, draw your bowstrings… From p. 233 of The Black Swan :

WEALTH DISTRIBUTION ASSUMING A GAUSSIAN LAW

Richer than €1 million: 1 in 63

Richer than €2 million: 1 in 127,000

Richer than €3 million: 1 in 14,000,000,000

Richer than €4 million: 1 in 886,000,000,000,000,000

Richer than €8 million: 1 in

16,000,000,000,000,000,000,000,000,000,000,000

Richer than €16 million: 1 in … none of my computers is capable of handling the computation

Leaving aside the obvious fact that wealth, like so much of the rest of life, is far from Gaussian, doesn’t this last “none of my hurrdurr” comment strike you as just so hilariously lazy ? None, Nassim ? Really ?! Like, you tried multiple machines and you couldn’t come up with anything >0 ??!!

As hard is this is to swallow, Taleb‘s poverty shan’t dissuade us from pressing on in our search for Truth! So let’s see if we can do better despite using the same tools and having a drastically shallower knowledge thereof.i

Given the probabilities above and a mean wealth of €40k,ii we can infer an SD of €446k. From this, we can calculate the number of sigmas from the mean of each of the wealth brackets rounded to three sigfigs :

Richer than €1 million: 2.24σ

Richer than €2 million: 4.48σ

Richer than €3 million: 6.73σ

Richer than €4 million: 8.97σ

Richer than €8 million: 17.9σ

Richer than €16 million: 35.9σ

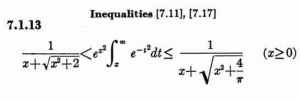

Events this rare – rarer even than the chance of a particle existing in the known universe – are rarely calculated and even more poorly understood.iii Thankfully, bright folks like Anders Sandbergiv dug up a Abramowitz and Stegun equationv for estimating the upper bound of probability for uber-sigma events like the one described by Taleb’s Gaussian wealth distribution.

Using A-S as our flexed bow and Mathematica as its silver arrow, we find that encountering a man with a net worth of €16 million in a Gaussian world has a probability of 1.527E-280% on any given day.vi

Recalling that there are only about 1.080E80 particles in the known universe, it turns out that Fuck You Money could never exist anywhere other than our baleful, beloved world.

And, furthermore, that it’s never the arrow, but the Indian.

___ ___ ___

- Whereas Taleb claims to have “spent almost all [his] career in quant finance and probability toying with Mathematica,” apparently it only takes a semi-nerd with a B+ in University Calculus and zero Mathematica experience to find the correct solution. Honestly, to replace the power supply on a throwaway iMac, upgrade its OS to 10.9 so that it’d run the program, download a torrent of Mathematica, and install the software took me fully 10x longer (maybe 5 hrs) than it did to figure out how to write the equation in a programming language I’d never used before (maybe 30 mins).

What the fuck does this say about the soi-disant “cream of the crop” ?↩

- When Taleb penned this in 2007, the OECD estimated average global net worth to be a smidge over $50k, which we’ll round to €40k because I feel like it, it’s close enough, and who the fuck trusts the measurements of those scammers anyways ? ↩

- I found research up to 25 sigma events but bizarrely little beyond that. Clearly, too much grant $payola is bad for the brain. ↩

- Sandberg is probably best known for his “Don’t touch that LHC” position paper. A stance he defends admirably.↩

- N[1/2(1-Erf[359/20sqrt2]),300]*100 ↩

[…] Taleb shied from the light, I entered stage right. […]

[…] quite 36 sigmas, but still a healthy delta! […]